Essity has reported a net sales increase of 25.1% in its Q1 results as it initiates a strategic review of its ownership in Asian hygiene company Vinda and the Consumer Tissue Private Label Europe business.

Between 1 January – 31 March 2023 the Swedish business reported net sales of SEK42,926m and an operating profit before EBITA increase to SEK4,445m.

Profit for the period increased to SEK2,703m.

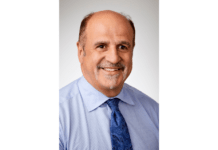

Magnus Groth, President and Chief Executive, said: “Essity’s sales and profitability performed positively in the first quarter, primarily due to attractive customer offerings and higher sales prices to compensate for the cost increase.

“Essity’s sales growth amounted to just over 17% for the first quarter of 2023, compared with the corresponding period of 2022.

“Sales prices were higher and the product mix better in all business areas.

“Volumes declined somewhat on account of the company’s prioritisation of higher profitability ahead of volume.

“Furthermore, volumes were negatively impacted by ongoing efforts to exit the Russian market and the discontinuation of the baby diaper business in Latin America.”

In the Consumer Tissue segment, organic sales growth for the quarter amounted to 19.7%, which the company said was “mainly as a result of significantly higher prices in addition to a better mix.”

Volumes were lower on account of the prioritisation of higher profitability ahead of volume.

Sales growth was high in all regions including Europe, Latin America and Asia.

For the Consumer Tissue Private Label Europe division, organic sales growth amounted to 35.8%, which was mainly related to higher prices.

Last Wednesday, Essity said it had initiated a strategic review of its stake in China-based Vinda and its Consumer Tissue Private Label Europe business.

Groth added the potential move aimed to reduce Consumer Tissue’s share of the company’s total sales.

The strategic review “includes exploring different options and may result in divestments, although no such decisions have yet been taken.”

Essity’s net sales for 2022 amounted to approximately SEK156bn, of which Vinda accounted for approximately 16% and the Consumer Tissue Private Label Europe business approximately 6%.

Vinda and the Consumer Tissue Private Label Europe business accounted for approximately 34% of the business area Consumer Goods net sales 2022 and approximately 45% of the Consumer Tissue category net sales in 2022.

Essity is the majority shareholder in Hong Kong-based Vinda with a 51.59% stake.

Vinda’s net sales in 2022 amounted to approximately SEK25.1bn and EBITA amounted to approximately SEK1.1bn.

Of Vinda’s net sales, 83% were related to tissue and 17% were related to personal care.

Net sales for the Consumer Tissue Private Label Europe business amounted to approximately SEK9.8bn in 2022, corresponding to about 15% of net sales in the Consumer Tissue category.

The business encompasses seven production facilities in Belgium, France, Germany and Italy.