The Polish market for kitchen towels has had a significant boost over the last 20 years driven by affordable products and wider choice.

By Ian Bell, Euromonitor International’s global head of tissue and hygiene research.

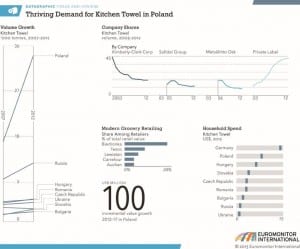

Over 2007-2012, kitchen towels saw the most dynamic growth among all categories in retail tissue in Poland, posting an 11% value CAGR to reach US$343 million. With a double-digit growth rate, the country has not only outshone the usual suspect when it comes to high growth in Eastern Europe, Russia, but also in other emerging markets, ranking fourth globally in terms of absolute volume growth 2007-12, behind Italy, Brazil and Turkey, and also among the top 10 in terms of value growth. Polish consumers have even started to appreciate the convenience of kitchen towels outside the kitchen environment, allowing them to perform all kinds of cleaning tasks, but a changing retail environment has also favoured category development and will continue to fuel growth at least over the short term.

WESTERN EUROPEAN INFLUENCE

Even though disposable income in Poland remains well behind that in neighbouring Western Europe, and French hypermarket chains Tesco and Carrefour have become important players in the Polish retail environment, both selling a variety of private label options next to branded tissue products. But, the expansion of the domestic discounter chain Biedronka, which holds a 22% share of modern grocery retailing in Poland, has driven category development in particular. All three of these stores’ private label products are among the category’s top six brands, and they were all able to strengthen their positions over 2007-12, stealing standing at US$ 8,000 compared to US$27,000 in Germany for example, per household spend on kitchen towels is quickly catching up. Whilst in 2007, Polish households spent US$4.00 on kitchen towels on average, the figure doubled to US$8.00 by 2012 and is set to reach US$14.00 by 2017, drawing level with the average household spend in Germany.

CHAINED RETAILERS PUSH PRIVATE LABEL FORWARD

The lion’s share of category growth is the result of rising demand for private label kitchen towels, which saw an increase in value share from 11% in 2003 to 43% in 2012, outperforming the category’s performance over 2007-2012 with an impressive 21% value CAGR.

It is not just the case that Polish consumers are price conscious and seek value-for-money kitchen towels, but the retail environment has also gone through a transition which has benefitted private label sales; within the last 20 years, the British and French hypermarket chains Tesco and Carrefour have become important players in the Polish retail environment, both selling a variety of private label options next to branded tissue products. But, the expansion of the domestic discounter chain Biedronka, which holds a 22% share of modern grocery retailing in Poland, has driven category development in particular. All three of these stores’ private label products are among the category’s top six brands, and they were all able to strengthen their positions over 2007-12, stealing share from Kimberly-Clark as well as Sofidel’s well-established brands.

“The lion’s share of category growth is the result of rising demand for private label kitchen towels.”

FOLLOWING IN GERMANY’S FOOTSTEPS?

Over the short term, it can be expected that demand for kitchen towels will continue to grow steadily, adding an additional value of US$100 million to category sales by 2017. Kitchen towels have become essential products in Polish households and consumers are able to afford them due to rising disposable income and an increasing product choice in the budget segment.

Similar to German consumers, Polish consumers are showing appreciation of discounters in grocery retailing in general, which will further strengthen the position of private label products. It is likely that, by the end of the decade, private label’s share of kitchen towels in Poland will reach German levels, where private label currently accounts for more than 70% of value sales of kitchen towels.

“Polish consumers are showing appreciation of discounters in grocery retailing in general, which will further strengthen the position of private label products.”

However, brands could seize opportunities in the premium niche with printed or coloured kitchen towels. In toilet paper, trade sources have confirmed that coloured and even fragranced products have proven to be a success; hence, there may be potential for growth in other tissue categories, as well.