Pirkko Petäjä and Mikko Helin, principals at AFRY Management Consulting, weigh the short- and long-term consequences for consumer tissue growth and AfH tissue market during and after the pandemic.

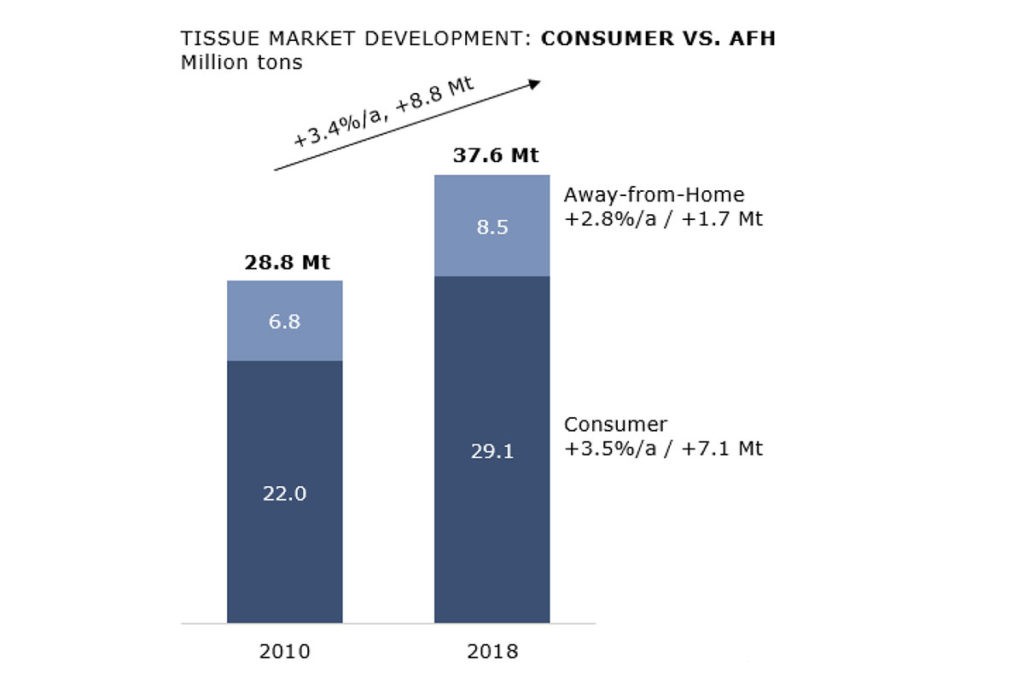

Globally the AfH share of total tissue market is slightly over 20% ranging from over 30% in North America to somewhat over 10% in China. In many mature markets the AfH segment shows a steady growth reflecting the, until very recently, fairly good general economic climate. However, in the large emerging markets and globally as a whole the consumer segment determines the total tissue demand growth.

Population growth is a major AfH growth factor. Developing, e-commerce and distribution networks also boost the AfH sales as well as innovative product anddispenser system offerings.

AfH is somewhat more volatile than the retail segment; in high economic cycles the high employment and increased travelling and eating out increase the AfH demand, but during economic downturns the opposite impacts are clear as well.

Some tissue companies are specialising on AfH and it can be seen as a way to enter new markets. Competition and entry in AfH is easier than in the consumer side where the large efficient PL producers, powerful retailers and the strong branded players dominate.

Private label grows faster almost everywhere

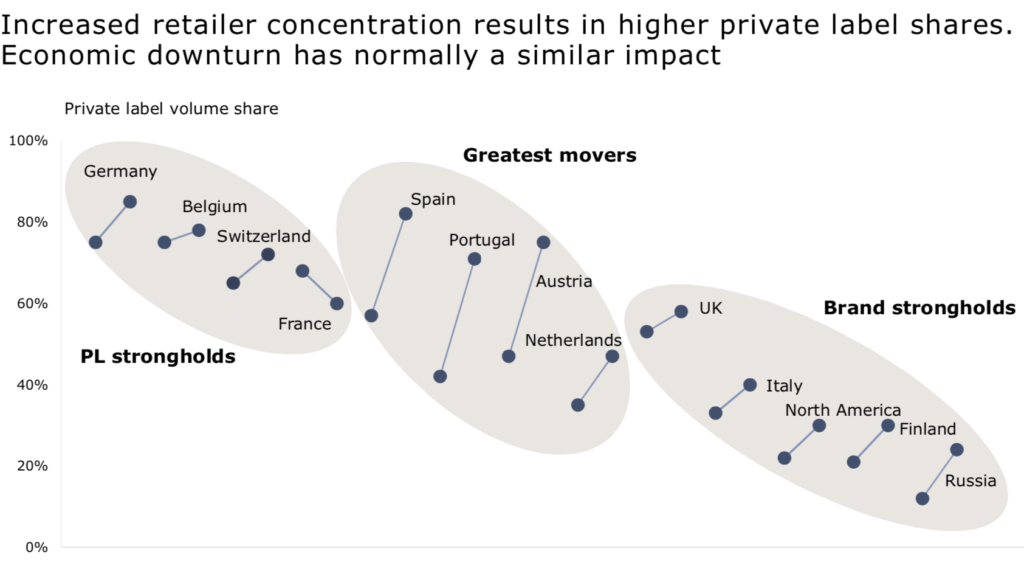

The retail tissue demand growth is strongly related to population growth and increasing number of households. Retail segment is less influenced by economic volatility as a whole, but during slow economic growth more consumers may choose retailer brands (private label) over branded due to lower price.

The Millennials are more loyal to the shops and retailers where they shop than to the brands. They also have financial struggles and may therefore prefer private labels. Millennials see private labels differently to the older generations; private labels have become products that deliver innovations, better quality and value for money. Private label quality has been becoming closer to that of brands; even the latest premium technologies are increasingly applied.

Private label is therefore the fastest growing segment in most tissue markets.

Its relative growth has accelerated in many regions that have been strongly branded in the past. In North America, the private label share was 22% in 2010, when it currently is some 30%. In western Europe, the average private label share in volume terms was 58% before the economic crisis, 63% in 2010, and is some 66% now.

Private label has increased throughout the mature markets, in some countries and time periods the development has been very fast.

Retail developments

The retailer development is also a great driver shaping the tissue markets. Developed out of modern retail, the concentration and prevalence of large chains and discount stores has an increasing impact on the tissue trade.

On-line retail continues to increase, though it still remains in a relatively low share of the total retail. Online shopping is, however, increasing in double digits. The younger generations have finally learned to use it increasingly even in groceries and the supply and delivery innovations have made it more attractive.

From the younger generations an increasing share make their daily shopping on-line and typically something like tissue paper is often together with other groceries purchased during various on-line promotions and sales campaigns. On-line shopping has an impact on purchasing habits; package sizes grow bigger, type of product may be impacted etc. Private label share in on-line shopping in general is still modest, but developments in consumer packed goods, like tissue paper are faster than in many other products.

The Millennials are more loyal to the shops and retailers where they shop than to the brands. They also have financial struggles and may therefore prefer private labels. Millennials see private labels differently to the older generations; private labels have become products that deliver innovations, better quality and value for money. Private label quality has been becoming closer to that of brands; even the latest premium technologies are increasingly applied.

Private label is therefore the fastest growing segment in most tissue markets.

Its relative growth has accelerated in many regions that have been strongly branded in the past. In North America, the private label share was 22% in 2010, when it currently is some 30%. In western Europe, the average private label share in volume terms was 58% before the economic crisis, 63% in 2010, and is some 66% now.

Private label has increased throughout the mature markets, in some countries and time periods the development has been very fast.

Retail developments

The retailer development is also a great driver shaping the tissue markets. Developed out of modern retail, the concentration and prevalence of large chains and discount stores has an increasing impact on the tissue trade.

On-line retail continues to increase, though it still remains in a relatively low share of the total retail. Online shopping is, however, increasing in double digits. The younger generations have finally learned to use it increasingly even in groceries and the supply and delivery innovations have made it more attractive.

The Millennials are more loyal to the shops and retailers where they shop than to the brands. They also have financial struggles and may therefore prefer private labels. Millennials see private labels differently to the older generations; private labels have become products that deliver innovations, better quality and value for money. Private label quality has been becoming closer to that of brands; even the latest premium technologies are increasingly applied.

Private label is therefore the fastest growing segment in most tissue markets.

Its relative growth has accelerated in many regions that have been strongly branded in the past. In North America, the private label share was 22% in 2010, when it currently is some 30%. In western Europe, the average private label share in volume terms was 58% before the economic crisis, 63% in 2010, and is some 66% now.

Private label has increased throughout the mature markets, in some countries and time periods the development has been very fast.

Retail developments

The retailer development is also a great driver shaping the tissue markets. Developed out of modern retail, the concentration and prevalence of large chains and discount stores has an increasing impact on the tissue trade.

On-line retail continues to increase, though it still remains in a relatively low share of the total retail. Online shopping is, however, increasing in double digits. The younger generations have finally learned to use it increasingly even in groceries and the supply and delivery innovations have made it more attractive.

From the younger generations an increasing share make their daily shopping on-line and typically something like tissue paper is often together with other groceries purchased during various on-line promotions and sales campaigns. On-line shopping has an impact on purchasing habits; package sizes grow bigger, type of product may be impacted etc. Private label share in on-line shopping in general is still modest, but developments in consumer packed goods, like tissue paper are faster than in many other products.

Will there be any long-term impact of the Covid-19 on tissue markets?

What is happening? During the outbreak of the Covid-19 pandemic, there is a curious phenomenon that takes place everywhere; people are stocking toilet paper. Producers report they have sold almost triple the amounts than normal.

This news has come from everywhere in the world. In addition to Europe, in North America and Australia there are videos of empty shelves and people fighting for the last toilet paper packages. Every one of us has been witnessing the at least temporary shortage in our own grocery stores. In some locations in North America there are limitations of two packs of toilet paper per client.

The market situation starts to reflect to prices, if not yet to the normal retail prices, however in e-bay type of platforms toilet paper can be sold at many times the normal price at the moment. There are also consequences when people start to use something else instead of toilet paper: in the UK sewers have been blocking due to substituting toilet paper with kitchen towel and non-flushable wet wipes.

Why toilet paper? Why do people buy toilet paper in a crisis? The basic demand does not much increase, or does it?

The first reason is the fear of the availability weakening or stopping. Similarly people fear that they end up in quarantine and cannot buy more, however, there are many other items facing the similar situation, why especially toilet paper?

Some say that toilet paper is a symbol of safety and preparedness. There is a comfort in knowing that it is there. In an uncertain moment there is at least something what you can do; buy toilet paper. It is something necessary and fundamental that you can control and you get a feeling of having control. In a health crisis there can also be a general fear of disgust and untidiness and toilet paper is a symbol of fighting that.

Very common is of course ‘everyone else does it’. It does not cross your mind normally, but when you see that people buy it crazily, the result is that you start to think that maybe you need to stock it as well.

What is the short term impact on the demand?

There is obviously a significant short term peak in the retail demand of consumer toilet paper. In addition to toilet paper, kitchen towels, hand towels, hankies, wet wipes, etc. Increases in the short-term due to hoarding, actual increasing need and also increased hygienic awareness. Retail demand increases also as people are increasingly at home. All suppliers emphasise the resilience of their supply chain and urge consumers not to panic- buy, there is no need for that, and actual shortage is not foreseen. Also production can adjust and be increased in relatively short notice.

Only very short-time shortages can take place. Some people may have to replace their favoured imported brands with local products, or some other hick-ups may occur.

In theory the ongoing Covid-19 pandemic should hit the whole AfH segment quite hard with decreased demand owing to people working from home, reduced travel, empty hotels, restaurants and schools. However,

at least at the very short term also the AfH demand has increased due to hygienic awareness, increased consumption of hand towels, usage in health care, hoarding among consumers and distributors etc. Regional differences may occur and the negative impacts may start to show a little later.

Will there be any long term impacts on behaviour and trading habits?

The coronavirus has rapidly accelerated the increase of the on-line grocery shopping. It can be requested from people in quarantine and become very useful for groups at risk. People can learn this new way and will continue to use e-commerce also after the crisis. It is likely that the coronavirus has an increasing impact on on-line shopping, maybe even permanently. This can consequently have an impact on package sizes, shopping trends (how much at a time), qualities favoured, branded vs. private label. These matters can change permanently.

In the long run the AfH demand can increase due to the increased hygienic awareness. Paper hand towels can be preferred compared to blow dryers after suffering of this airborne infection, hankies can be increasingly used and they will be thrown away quicker after use. Generally speaking the increased hygienic awareness will have an increasing impact on all tissue paper, including even toilet paper demand.

Impact of the economic crisis

Economic downturn has a known impact on tissue markets; normally the impact on demand in volume terms is not necessarily high, but there is a shift towards lower qualities and prices, private label typically increases on the cost of branded.

AfH normally suffers from an economic downturn. Depending on how badly the world is hit, there can be difficulties to reach the pre-crisis levels in e.g. travel and tourism related consumption. However, in the long term the Covid-19 pandemic may lead to increased demand of hygienic and health products due to, for example, greater focus on hand hygiene.

The industry may also suffer due to operational and financial problems. A few temporary closures have taken place in the worst areas for precaution reasons (some mills, like Duni, Rexcell for market reasons). Luckily many mills have already been allowed to re-open, especially in China. The production breaks have an impact on the economy of the companies. Pulp prices in the long run typically do not peak during a downturn, which might be a positive factor after the shorter term supply/ demand imbalances. There can, however, be severe financial difficulties for some of the companies, projects will be delayed, etc. that can impact the machinery and service suppliers and the whole branch.

The economic crisis due the Covid-19 will be unprecedented. Nobody knows how bad it will be but undoubtedly it can have a direct and indirect impact also on tissue industry. Tissue and hygiene is, however, one of the businesses where the demand is fairly resilient in economic crises, though there will be differences between regions and shifts between segments and categories.