By Simon Creasey, Freelance Journalist

Sales of household paper products at the top four superstores have slumped. The reasons – branded sales fall, the rise of own label, a price war, discounters and bargain stores, and more online shopping. But does it foreshadow a deeper crisis across the global industry? Simon Creasey reports from the front line.

This poor performance has hit the household paper brands hard with some enduring significant falls in value and volume sales. Retailer range reviews haven’t helped matters as some brands have lost listings.

These flagship paper brands have also been battered by retailers placing a greater emphasis on own label products. Own label value sales of toilet tissue rose 5.8% in the last 12 months, whereas total category sales were down -0.8%. Facial tissue own label sales were up 9.9% against toilet category increases of just 1% (Nielsen).

So why are consumers shopping elsewhere for household paper products, where are they spending their money and what are the grocery retailers and the brands doing to claw back market share?

The reason the big four grocers in the UK (Sainsbury’s, Tesco, Morrisons and Asda) are struggling to shore up sales of household paper products is that consumers are increasingly purchasing more of these products from the discounters, bargain stores and even Amazon, from whom they are buying in bulk.

Kantar Worlpanel data reinforces this shift, with bargain stores increasing value sales of all household products by 2.9% year-on-year in the 52 week period to 8 November 2015. During the same period discount retailer Lidl grew value sales of household products by 7.3%, Iceland by 8.1% and Aldi by a whopping 21.9%.

Although sales of branded products continue to dominate the total household category, with a value share of 70%, Camille Streicher, an analyst at Kantar Worldpanel, says own label is catching up fast.

“The continued growth of own label is driven by strong performances from the discounters, in particular Aldi which has experienced double digit growth in the past year,” explains Streicher.

“More specifically, the main sectors bolstering own label growth are: fabric conditioner (+19.9%), laundry (+7.5%), toilet roll (+7.2%) and autodish (+7.1%).”

Sales of own label facial tissues are also faring well at the moment, showing value growth of 6.3% off of volume growth of 12.9%. On the flipside own label kitchen roll sales slumped -4.4% in value with volumes marginally up by 1% – the reason for the fall in value is due to the average price of a pack of own label kitchen rolls dropping by -5.4% (Kantar).

On the flipside, brand owners are struggling. Sales of branded toilet roll fell -2.1% in value and -1.9% in volume in the last year, facial tissue sales dropped -2.3% in value and -6% in volume and although sales of branded kitchen rolls increased by 5.6% in value and 3.4% volume, this was in part due to the 2.2% increase in the average pack price (Kantar).

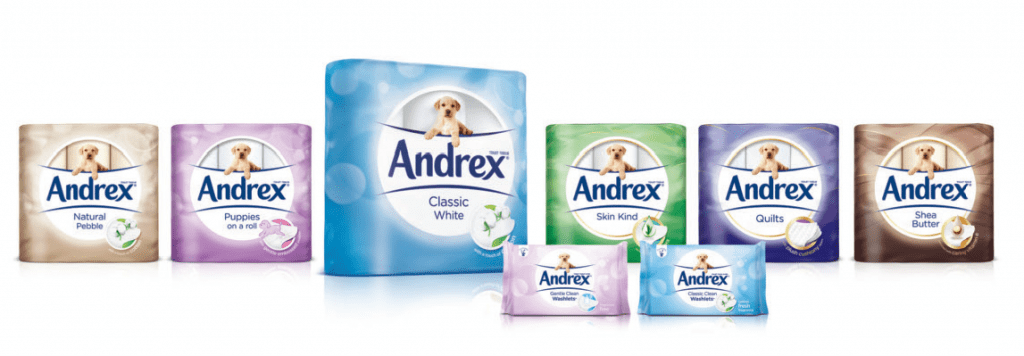

The worst hit paper product brands were Andrex (value was down -8.5% with volumes down -7.5%), Velvet (value sales down -9.9% on volume sales of -8.5%) Kleenex (value -4.5% and volume -3.4%) and Thirst Pockets, which saw value sales slump – 18.8% with volumes falling by -21.4% – this was despite the fact that over the recorded period the brand pushed through a 3.3% increase in the average pack price.

The contrast in fortunes between branded and own label products is due to a number of different factors, according to Gary Earle, sales director at Accrol.

“The quality of the multiple grocers’ private label ranges is improving to match or even exceed the brands and the consumer is buying into this,” says Earle. “There is very little true new product development on dry toilet tissue from the brands and to win back the consumer their only strategy seems to be consistent promotional activity.”

This is largely due to the fact that while any economic recovery still seems pretty fragile, post-recession consumers love nothing more than a good bargain. Consumer research undertaken by Mintel found that 51% of shoppers look for special offers when purchasing toilet paper – the equivalent number for kitchen roll and facial tissue shoppers is 44% and 42% respectively (Lightspeed GMI/Mintel November 2014).

That’s not necessarily to say that the large brands have been guilty of falling into the trap of over promoting. Andrex marketing director for family care, Karel Van Der Mandele, says that although value continues to be important for shoppers, whether through promotions or everyday pricing, the “percentage of volume sold on promotion is relatively flat year-on-year”.

In response to why the brand’s value and volume sales were hit so badly in 2015, he says: “The nature of our customer and portfolio plans in 2015 meant the majority of in-store and promotional support plans shifted towards the second half of the year. Our momentum and share has subsequently picked up.”

Retailer range reviews also haven’t helped matters. The big four grocers have put a growing amount of pressure on suppliers to deliver keener pricing as they’ve stepped up the price war between each other, whilst at the same time attempting to ward off the growing threat of the discounter groups. Andrex was particularly badly affected by a Tesco range review in late 2014, although Van Der Mandele believes that the brand has emerged from the process with a much stronger proposition.

“Many retailers have undergone range rationalisation over the last two years in order to simplify the shopping experience for their customers,” he says. “In most instances these decisions are being made in such a way that benefits the shopper by reducing complexity, but retaining shopper choice. We as category leaders have taken the lead by simplifying our own portfolio, removing four variants from the range and consolidating our core range to focus on product benefits.”

So what are manufacturers of paper products doing to fight back? Some are experimenting with pack formats to meet changing consumer demand.

“We identified that the consumer is now trading up from standard grade toilet rolls to premium in either brand or private label and the trend is still continuing towards larger pack sizes – anywhere from nine rolls upwards,” says Earle.

To cash in on the premium trend Accrol has developed a new premium quilted toilet roll, which according to Earle is a “true” quilt. “Many of our competitors state quilted on their pack claims, but in effect it is an embossed and laminated product, not a true quilt,” he explains.

Similar consumer purchasing habits are also being exhibited in the kitchen roll sub-category. “The star performers are the larger sheet jumbo kitchen roll and multi-purpose roll,” says Earle. “The consumer is trading up to these types of products.”

In response to the growing premium push Accrol has invested £9m in three new converting lines that are capable of producing premium grade products.

Andrex brand owner Kimberly-Clark also splashed the cash on a multi-channel marketing campaign, including a 30-second TV ad slot, in August, which it hopes will bring “shoppers back into the brand and help drive brand power.” And it unveiled a packaging refresh for its entire portfolio last spring.

However, the major problem for the big brands is that packaging tweaks and range additions aside, there has been very little genuine new production innovation over the last 12 months or so. It’s a situation succinctly summarised by Oday Abbosh, founder of Better All Round, which reinvented the kitchen towel by launching Ora in 2012 (see boxout).

“All of the big players have got hundreds of millions of dollars tied up in heavy equipment,” says Abbosh. “Their capex is enormous and all of that equipment was laid down years ago so everything they do is based around optimising the operation of those plants and eking out every ounce of inefficiency so that they get a fantastically smooth running, low cost machine. The downside to that is you have zero opportunity to innovate because you just keep producing the same old same old. All they can do is say ‘let’s add more sheets to the roll, or reduce the number of sheets or play around with paper substrates.”

Despite Abbosh’s gloomy prognosis, there is room for optimism for the household paper products category. For starters, the projected population growth will help operators in this ‘needs driven’ market – Mintel says that the 4% more people who are expected to live in the UK by 2019 will help drive up volume sales of toilet and facial tissues, with kitchen roll products also expected to prosper.

Richard Caines, senior household care analyst at Mintel, says: “Some 1.1 million more households in 2019 compared with 2014 will benefit sales of kitchen roll, especially if more of them can be encouraged to use it for a wider variety of tasks, potentially boosting the market by £70m.” Home entertaining could also play a vital role in future sales growth.

“Home entertaining can help boost the value of sales of household paper products, including use of kitchen roll when cooking, as well as the purchasing of more premium toilet tissue, tissues for guest rooms and paper napkins,” adds Caines.

He also thinks there is an opportunity for facial tissue brands, which have been struggling for a long time now, to grow sales by encouraging higher usage – particularly among men and younger people, who only tend to buy them when they have a cold.

The relatively new moistened toilet tissue sub-category also offers scope for future growth. “Moistened toilet tissue has further growth potential, particularly if more people can be convinced of its value as a complementary product to dry toilet paper and concerns about it not flushing away can be overcome,” says Caines.

These changes are not going to happen overnight, but he’s optimistic about the categories’ future outlook if some of the major branded players can get their heads around the current challenges facing them and respond to changing consumer needs and purchasing habits.

“Shifting purchasing away from being commodity-focussed through more segmentation of the product offer and the promotion of new features is needed to help return the household paper products market to growth,” believes Caines. “This includes making toilet tissue and facial tissues more focussed around people’s personal care routines and the development of kitchen roll in different variants that clearly targets the features most important for different uses of the product.”

Abbosh agrees with this assessment. He thinks that the big brands could be flush with success in the future, but only if they undergo a shift in mindset. “I personally think that there will come a time when this industry will need to adapt massively – like so many industries have already done – to the change in consumer behaviour and what it is possible to achieve through the use of technology,” says Abbosh.

“This industry has tried to avoid having to accept the seismic changes to consumer shopping habits, but it’s going to come to the paper industry in the fullness of time. The big players have all got tonnes of marketing dollars that can sustain their businesses for a long time, but looking further into the future they will need to shift more towards developing a range of different products that are much more consumer-led, rather than manufacturing efficiency-led.”

Simon Creasey is a UK-based freelance journalist who was formerly associate editor [features] at The Grocer, a British market leading magazine devoted to grocery sales.

Case study: Better All Round

“We started looking at this problem from a consumer perspective without having a clue about how to make the product,” he recalls. His solution was to develop a round kitchen roll that is stacked on top of one another rather than perforated, which means it can be used with one hand.

After fine-tuning the product Abbosh secured a two-year exclusivity deal with Tesco through a contact and Ora is now stocked in more than 1,400 stores. The exclusivity period ends later this year and Abbosh says that despite doing no international marketing of the brand he’s already been approached by retailers, wholesalers and distributors in more than 25 different countries.

The big problem he faces now is stepping up production to meet projected capacity demands. “To date we have funded everything through friends, family and contacts. We’ve taken no private equity, venture capital money or debt. But we have to build new machines and ramp up capacity so that we can meet future demand for our products. We’re having discussions about how we can achieve that at the moment.”