Rapid changes in supply and pricing in the pulp market presents major challenges for both suppliers and buyers. The need for price hedging tools is likely to increase. Report by Pierre Bach, Hawkins Wright research manager.

More than 37% of all bleached chemical market pulp shipments went to the tissue industry last year. This compares with just 27% in 2010, with market pulp consumption within this sector expanding at an average rate of 8% pa during this period, equal to 1.1Mt/yr.

We expect the tissue sector to continue to grow in prominence during the next five years, as more virgin fibre content tissue capacity is installed which will mostly be dependent on market pulp.

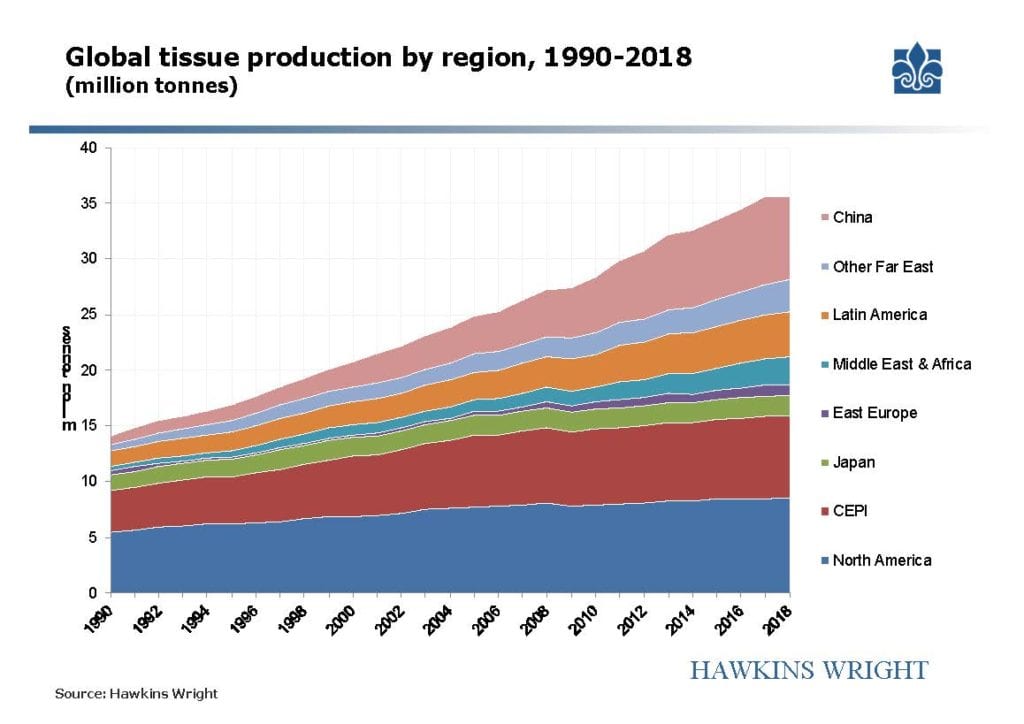

Global tissue production is estimated at just over 36Mt in 2018, having risen

by an average of 3.2% pa (~1 Mt/y) since the financial crisis. Around 47% is

produced in the mature markets of North America, Europe and Japan, where growth has averaged 0.9% pa, 1.3% pa, and 0% pa respectively.

These regions also account for the highest proportion of recycled based tissue demand. Fortunately for the market pulp sector, growth is much stronger in emerging markets where most tissue is based on virgin fibre. Indeed, even in the developed economies, recycled-based tissue production has been limited by the falling availability of high quality recovered fibre, much of which derives from the dwindling P&W paper sectors.

As a result of these and other furnish trends, the mature regions have consumed increasing volumes of market pulp, even with only modest overall production growth.

Last year saw a continuation of these trends, with particularly healthy growth in China, where preliminary estimates suggest that production has increased by just over 8%, despite the economic slowdown.

Although global growth is increasingly geared towards China (now the largest market in the world), this positive performance was also supported by other emerging markets such as Brazil (+3.9% y-t-d), and also Korea (+8.7% y-t-d). Meanwhile, output in Japan has contracted by 1.4% so far, and CEPI statistics show European production down 0.2%. The AF&PA reports tissue production growth of just 0.6% in the US over the first ten months.

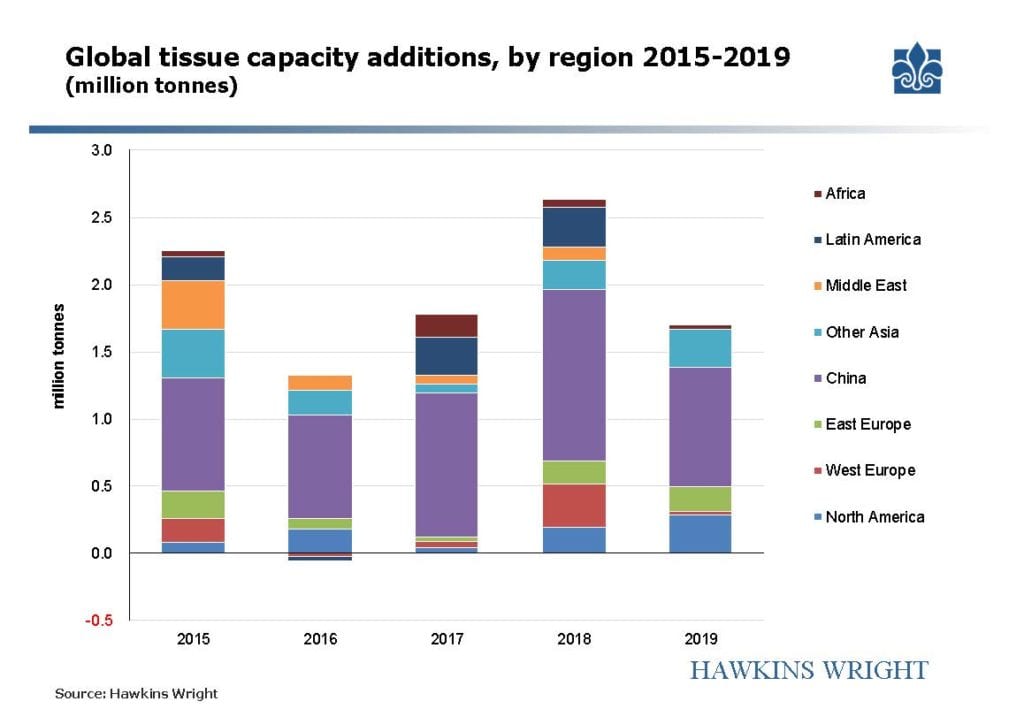

Broadly speaking, investment trends reflect these regional patterns, with China clearly dominating. However, in all markets capacity growth has exceeded underlying demand quite significantly, clearly to the detriment of operating rates and pricing power. Capacity growth reached a record-high of +2.7Mt in 2018, more than double the rate of growth in output.

It should be noted however that there has been a huge amount of capacity rationalisation in China, and it is almost impossible to accurately determine the real net capacity growth after accounting for capacity closures.

Furthermore, operating rates are likely to vary quite significantly from mill to mill, with some of the newer machines starting up very gradually, particularly in China and Indonesia. Capacity growth is expected to fall back to 1.5Mt in 2019, somewhat lower than the past two years, but still well in excess of the growth in underlying consumption.

Challenges of over-capacity are of course exacerbated by the tissue market structure, where large supermarkets and retailers dominate. Such Fast Moving Consumer Goods (FMCG) companies are highly price sensitive and invariably demand long-term (annual), fixed-price contracts. The penetration of private label (i.e. supermarket brands) over branded products in recent years has intensified the pressure on prices and margins.

This evolving competitive landscape was certainly a contributing factor behind Kimberly-Clark’s decision last year to consider the sale of its European tissue business where challenger brands have been particularly aggressive in trying to grow their market share.

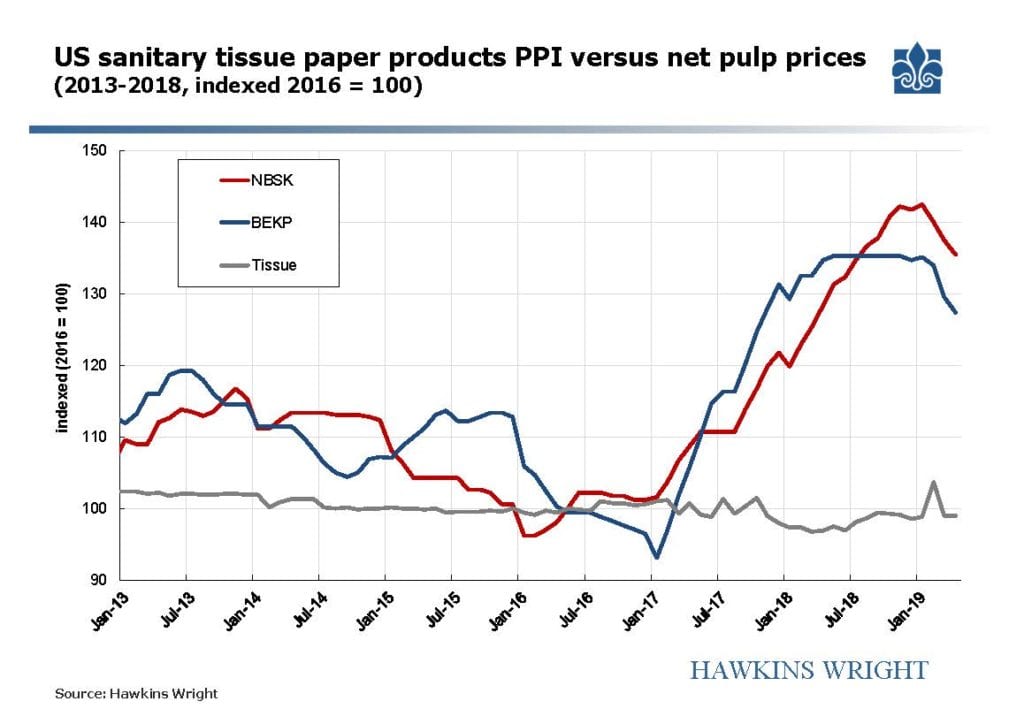

Tissue prices remain rather opaque, but we can draw on two examples to illustrate the squeeze felt by mostly non-integrated producers in North America and Europe.

The US’s Bureau of Labor Statistics publishes a producer price index (PPI) for tissue products each month, and we have rebased it using 2016 as a base year. Taking North American net pulp prices and building a similar index produces the graph across.

We can observe that since January 2017, NBSK and BEKP net prices have soared by 40% and 45% respectively while tissue prices have remained virtually flat (-3%) – implying intense margin pressure.

In fact, the data reveals that tissue prices peaked in Q3 2012, and have been on a deflationary trend ever since. A small uptick in the second half of the year appears to have been short-lived, with prices falling back in Q4 despite efforts from leading North American tissue suppliers to increase prices. Looking at Q3 reported earnings, very few could boast double-digit EBITDA margins, and a handful appeared precipitously close to 0%.

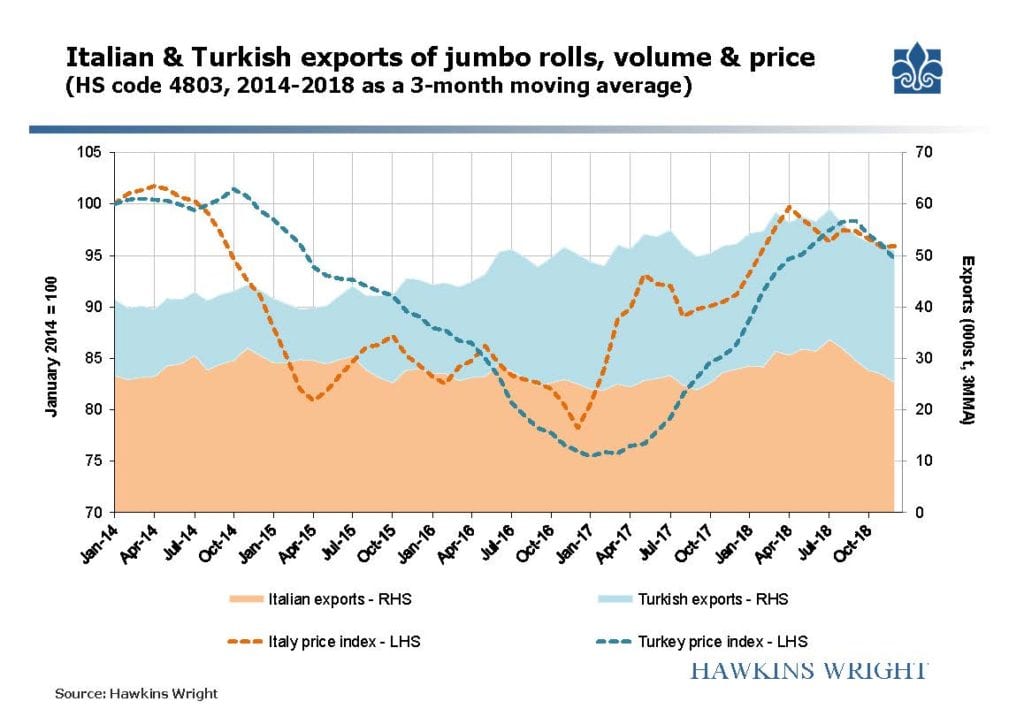

For Europe, we have used trade statistics from Italy and Turkey, whose combined exports of jumbo (or parent) rolls has increased by around 30% over the past four years (from 500,000 tonnes in 2014, to around 650,000 tonnes in 2018).

Turkey has developed most recently, with over 0.5 million tonnes of capacity installed from 2011-2016. Turkish capacity growth peaked around 2014-15, and for a period the growth in Turkish exports seemed to occur partly at the expense of Italian volumes. Prices fell by 25% as a result of this competition, but also because pulp prices were also trending lower for much of this time, lowering production costs.

Through 2017 exports from both countries have increased, and prices have recovered at the same time. This recovery may be related to stronger macro-economies, slower capacity growth and the weaker euro. However, the cost inflation resulting from the pulp price increases has clearly played a key role.

Note however, that whilst the tissue price indices have barely recovered to their 2014 levels, pulp prices exceeded their previous peaks by 25-35%.

Although monthly trade data is only available until July for Turkey and September for Italy, it appears that the collapse of the Turkish lira (which started through Q2 and gathered pace in Q3) has encouraged a rise in export sales, once more at the expense of Italian volumes and prices. Of course, this could also relate to slowing macro-economic activity across the Eurozone, or indeed production curtailment in Italy resulting from margin pressure.

The decline in pulp prices through November and December may provide some much needed respite, providing it does not cause a commensurate fall in tissue pricing.

We expect the global tissue sector to absorb an additional 5Mt of market pulp over the next five years, by which stage it might account for 41% of global BCP shipments (and fluff a further 11%).

The rapidly changing structure of the pulp market presents major challenges for both suppliers and buyers, given that market pulp remains as volatile as ever, whilst very soon over half of global BCP shipments will be geared towards sectors that are highly price-sensitive and operate on long-term, fixed-price contracts. Logically, the requirement for price hedging tools should increase under such a scenario.

Another potential result could be a trend towards integration within the tissue sector. Perhaps the most obvious example is APP, which has integrated over 0.8Mt of pulp capacity into tissue at the Hainan complex in China, and a further 1.5Mt in Indonesia (tissue machines have been installed at all three pulp mills in Jambi, Perawang, and most recently OKI).

In China, several smaller pulp lines (both hardwood and bamboo) have integrated partially or entirely e.g. Lee & Man, Guizhou Chitianhua, YFY Dingfeng. In Brazil, Suzano has installed machines in both Imperatriz and Mucuri mills, and has also acquired Facepa.

In the USA, Woodland (St. Croix) and Resolute Calhoun are now partially integrated. In Portugal, Navigator has added a new machine at the Cacia pulp plant in Q4 2018.

In reality these investments were made for different reasons specific to each company.

Indeed, rather than tissue producers aiming to reduce exposure to the pulp cycle, certain investments were in fact motivated by higher cost pulp mills wanting to reduce their own exposure to low pulp prices, or shrinking domestic demand. Such are the difficulties in predicting pulp cycles.

Perhaps the greater threat to our forecast is posed by general macro-economic activity, which is showing signs of a slow-down in early 2019, particularly in China. As we have mentioned, tissue demand has held up very well even as GDP has slowed, because the economy is transitioning towards consumption rather than investment.

However, part of the growth has also been generated by the closure of smaller mills, and the displacement of low grade tissue based on straw and wastepaper. The potential for further displacement is much lower, meaning that future growth will depend solely on domestic spending and rising living standards amongst China’s poorer population.