By FOEX Indexes’ Lars Halén and Timo Teräs

NBSK pulp Europe:

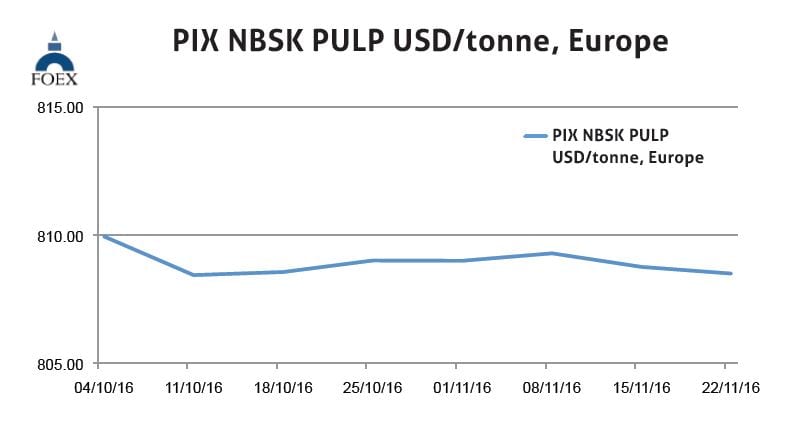

The softwood pulp market remains relatively stable. Price pressures have, however, recently been rather downwards than upwards, in spite of the so far quite good delivery volumes and low producer stocks.

One reason for this has been the strength of the dollar. Europrices have, in fact, headed upwards in Q4 and are now 3.4% higher than in the beginning of the year. The other reason is the suspicion, without proof, that the softwood consumer stocks are high in Asia. European consumer stocks, released by UTIPULP, show that consumer stocks in Europe are low, in October down by nearly 3% from September and by nearly 9% against October 2015.

Softwood market pulp consumption was up in October by 3.6% from September and by 2.8% from October 2015. Our PIX NBSK index slipped lower, as it retreated by 26 cents, or by 0.03%, and closed at 808.51 USD/tonne. US dollar strengthened against the Euro by as much as 2.4% (weekly average).

With the further weakening of the Euro against the US dollar, the benchmark value in euro, converted from the dollar value index with the average exchange rate of week 46, moved up from the previous week by 18.03 euros, or by 2.45%, and the PIX NBSK index value in euro-terms settled at 754.35 EUR/tonne.

BHK pulp Europe:

In BHKP, basic numbers appear weak with market BHKP demand up this year less than in softwood and with producer stocks high, at least still at the end of September. The market shows some signs of strengthening, however. October shipments are assumed to have gone up. That will be verified in a couple of days after writing these notes.

Speculative buying, in view of project delays and increased downtime, helps demand side. At least one modest price increase announcement has been made in Europe. The decline of our PIX BHKP index value came to a halt, at least temporarily, as the benchmark value moved this time back up by 1.31 USD/tonne, or by 0.20%, and closed at 654.79 USD/tonne. The value of the Euro depreciated last week by 2.4% against the US dollar (weekly average). When converting the USD value of the BHKP benchmark into the weakened Euro, the PIX BHKP index value headed higher by 15.99 euro, or by 2.69%, and closed at 610.93 EUR/tonne.

Paper industry: The so far available data over the paper industry activity in October is predominantly positive. US box shipments were up by just over 4% against October 2015, when taking into account the lower number of shipping days in 2016. Total containerboard production was up by 1.3%, year-on-year. While modest, this was still better than the so far 0.4% cumulative gain. The best news was that the containerboard stocks fell by 140 000 tonnes, to the lowest level seen in four years in week’s supply terms. Not too surprisingly, the price increase attempts made from 1 October were pushed through by the market strengthening, with a lot of help from hurricane Matthew.

Containerboard market has done quite well also in Europe. October numbers are not available yet but during the first three quarters, European demand was reportedly up by 3.1% and the news from the market suggest that the rate of activity remained satisfactory also in October. Graphic paper data is not available, except for the US uncoated free sheet which, taking into account the one less shipping day, was down but only by 0.1% against a fairly strong October 2015. Finally, US boxboard production was up by about 2%, year-on-year.

About FOEX

Subscription: For access to the latest PIX Pulp and Paper index values and commentary, please subscribe to the “PIX Pulp and Paper Service” via the following link www.foex.fi/subscribe/

FOEX Indexes Ltd produces audited and trade-mark registered PIX price indices for certain pulp, paper packaging board, recovered paper and wood based bioenergy/biomass grades. The PIX price indices serve the market in a number of ways. They function as independent market reference prices, showing the price trend of the products in question. FOEX sells the right to banks and financial institutions to use the PIX indices for commercial purposes, while RISI Inc. has the exclusive re-selling rights for subscriptions to the PIX data and market information. Please enquire for subscriptions at [email protected] or via the following link www.foex.fi/subscribe/.

Tissue papers are produced either from virgin fibre, recovered fibre and various mixes of both, depending on the end product. High quality hygiene tissue products like medical tissue products, facial tissues, table napkins or other such household and sanitary products are often made exclusively or almost exclusively from virgin fibre pulp, whereas the share of recovered fibre typically increases in tissue products for a variety of end uses outside personal hygiene, such as kitchen towels or towels for garages or other such industrial

production facilities etc. Providing PIX pulp price indices gives the paper producer and buyer insight in the price trends with a weekly frequency. PIX indices are used as market reference prices e.g.

– by banks or exchanges that offer price risk management services for pulp buyers and sellers

– by buyers and sellers of pulp or paper in their normal supply contracts

– companies who want to employ an independent market reference price for internal pricing (e.g. pulp mill – paper/paperboard mill, paperboard mill – box plant) through licensing the commercial use from FOEX.

In addition, our price indices are widely used in financial analysis, market research and other such needs by all kinds of parties linked directly or indirectly to forest product or wood-based bio-energy industries.

This way the companies have better tools to budget their cost or income structure and profitability, and may concentrate on their core businesses with less time spent on price negotiations, which tend to increase in these days as the planning span narrows in the wake of the short, quarterly business cycles and, nowadays, in most cases, monthly raw material pricing decisions.