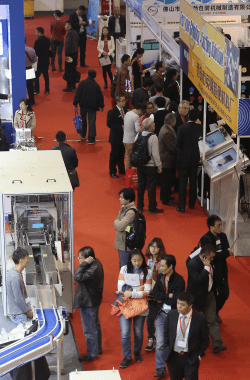

With the world’s eyes on China and its tissue industry, Asia’s largest international show specifically dedicated to the sector gave visitors unparalleled access to the key movers and shakers as well as the most vital information and forecasts to help businesses stay one step ahead of the competition. A TWM report

TW Asia attracts 2,899 key participants; Hengan, SCA and Neilson present senior management session

Cultural habits of tissue use across China are changing rapidly, and coupled with dramatic urbanisation, a rampant price war and substantial overcapacity, the need for Tissue World Asia is more apparent than ever.

Key players from the market exhibited and attended Asia’s largest event dedicated to the tissue market, a three-day event held between 11-13 November at the Shanghai International Exhibition Center, Shanghai.

The 2,899 key participants attended the event from China, Korea, Taiwan, Indonesia, Japan, Kuwait, and India, as well as from countries as far ranging as Italy, Germany and the USA.

The two-day conference addressed the key issues impacting the region, from its changing demographics and ageing population to an increased competitiveness in the tissue market resulting from a fierce price war.

The event offered visitors crucial insight on the issues that matter, presented by key industry personnel.

For the first time Tissue World Asia also hosted a senior management session with the significant presence of companies of the caliber of Hengan, SCA, WWF China, Fisher International, RISI and Nielsen.

Other speakers include: Kemira, Xerium Technology, Voith Paper, Gambini, TMC, Novimpianti and Solenis and more.

Despite its slower growth rate, China has continued to account for the highest share of the global tissue market expansion based on volume growth, claiming 39%.

The overcapacity situation grows increasingly serious: while new capacity expansions are rampant, project delays and cancellations are typical.

For example, APP has last year brought eight tissue paper machines on stream at its mills in China and Indonesia.

However, this is just a fraction of last year’s announced plans to build 52 tissue machines in the two countries.

APP has since put more than half of the planned machines on hold.

Tissue World magazine visited the company last year for the East China country report in the September/ October issue.

Evelyne Hu, APP China chief executive, told TWM that given the country’s giant population, average annual consumption of tissue paper in China still has a large gap compared with developed countries.

As market demand keeps climbing, she added a better balance should be achieved between supply and balance.

However, Hu also warned that fierce competition may lead to lower priced products, resulting in a price competition she said will “ultimately harm the whole market”.

TWM also visited Sun Paper, a Yanzhou-based tissue mill headed up by general manager Kevin Liu.

He said one of the main challenges for the market was brand recognition.

New to the tissue sector, the company’s decision was because of the potential for the tissue market created from urbanisation and improved living standards.

Significantly, he said the tissue industry in China is “just starting”. “People are changing the way they use tissue, we are definitely seeing an increase in high-end products,” he said.

Baoding-based Hebei Yihoucheng’s general manager Tian Yuwei also highlighted that potential for the facial tissue market in northern China, and he said brand identity “was key”.

He added that the environment was also an important strategy for the company.

The Chinese government has recently tightened up its pollution control measures in the nation’s Environmental Protection Law, which at the time of going to print was due to come into practice 1 January 2015 and will mean stiffer fines against polluting companies.

For the tissue sector, this means mills were being urged to use gas instead of coal, as seen at Hebei Yihoucheng.

Yuwei added that “environmentally-friendly products are the future .. we will continue to invest here”.

TWM summaries some of the key talks from Tissue World Asia:

Overview and prospects of the tissue paper industry in China; Jiang Manxia, Secretary General, China National Household Paper Industry Association (CNHPIA), China

Continuous Growth:

- Production volume, consumption volume and export volume all maintained rapid growth

- Production technology, equipment level and product quality continued to improve

- Investment projects increased, production scale and ability increased rapidly

- Competition became fiercer, industry structure optimized and upgraded

- The entire industry was full of vitality, showing generally good development and continued to attract the attention

- from global and Chinese other paper grades industry.

- Output/1000t – increased 8.5% to 6808 from 2012 to 2013; Sales volume/1000t increased 8.5% to 6638; Net export/1000t increased 22.2% to 601.6; Consumption/1000t increased 7.2% to 6036

Calculating the per capita disposable income of all residents:

The annual per capita consumption in Shanghai and Beijing is 10.1kg and 9.8kg, reaching the level in developed markets.

The provinces (cities, autonomous regions) where per capita consumption reaches 5kg and above: Zhejiang, Tianjin, Jiangsu, Guangdong, Fujian The provinces (cities, autonomous regions) where per capita consumption below 3 kg: Yunnan, Guizhou, Gansu, Tibet.

Ranking of consumption volume in the world – still the third largest consumption area in the world, after North America and West Europe Consumption volume accounted for about 18.8% of the global volume in 2013 (the global consumption volume in 2013 was 32.50 million tonnes according to the latest data by RISI, the percentage of China is 18.6% calculated on the data by CNHPIA).

Overheated investment led to production overcapacity:

- The existing enterprises continued to increase new capacity. Many enterprises and capital from other industries also entered tissue paper field. Overheated investment caused production overcapacity. The market competition became more in tense.

- The growth rate of consumption volume and annual per capita consumption is lower than that of capacity. The growth of consumption is slower than that of capacity.

- With the launching of new projects, the capacity utilisation rate continued to decrease, less than 80%.

- The price decline and cost increase further narrowed the profit margins of tissue paper enterprises.

Price competition became more intense and the cost increased:

Product price declined. The average price per tonne of tissue paper dropped by 300 RMB in 2013, which was 2.9% lower than 2012. The price decline in 2012 continued.

The growth of sales revenue was lower than sales volume in 2013, which also verified the price decline.

In order to fight for and get the market share, enterprises enhanced product promotion and brand publicity. In the first half of 2014, the percentage of market sales and promotion cost in the sales revenue increased than the same period in 2013.

Hengan: the distribution and administration cost increased, accounting for about 27.0% of Hengan’s total revenue (24.1% in the first half of 2013). This is mainly because Hengan put more efforts on product promotion and brand publicity. And it also increased spending on expanding new professional sales channel and product R&D.

Vinda: strengthened the market publicity and sales promotion to keep the market share. Besides its other revenue in the first half of 2014 significantly decreased (such as the government subsidy). As a result, its operating profit dropped 9.9% to 345.7million HK dollars.

CNSN: In order to keep the market share, the company continues to strengthen the control of major sales system in the country. It increased spending on marketing and promotion. So the growth of its main business increased slightly than the same period of 2013. The growth rate of its revenue from main business is lower than the sales volume of main business. The sales cost increased by 9.95%.

Backward capacity elimination and new projects postponed.

The capacity eliminated and shut down in 2013 reached more than 0.2 million tonnes.

The overseas tissue machine manufacturers establish plants in China. Some parts are localised: Valmet, Andritz, Voith, PMP, A. Celli and Kawanoe Zoki.

Rigid Demand: Tissue paper products are little influenced by the economy, because they belong to the FMCG and has the characteristics of rigid demand.

Market prospects: development opportunity and potential:

Tissue paper consumption is driven by the factors such as economy development.

China’s economy is still developing steadily. The household disposable income and purchasing power continues to improve. The population is increasing. The urbanisation process is accelerating. All these will drive the growth of tissue paper consumption.

Towels have large growth potential:

The percentage of towels in tissue paper is relatively low in China, such as AfH hand towel and paper napkin is only 6.6%, kitchen towel is only 0.7%, which still has a large growth potential compared with the 30% percentage in overseas mature market.

The products such as kitchen towel already start to grow in the costal area now.

Supply and demand developments in the growing Asian tissue business; Esko Uutela, principal – tissue, RISI, Germany

Asia offers major potential for tissue: it accounts for 60% of the world population and 42% of global GDP

World tissue consumption:

Asia’s share of global tissue consumption (34%) is still much below its share of global population (60%) and GDP (42%).

Global consumption: 32.4 million tonnes (2013).

Asia has accounted for almost half of the global volume growth of tissue consumption since 2000 – one third of global growth is in China.

Expected regional volume growth of tissue consumption 2013-2023: 39% of global growth in China! Asia’s role as the global driver is increasing, 55% of the expected volume growth in the next 10 years will be there.

Recent tissue market growth in the Asia Far East region shows rather steady but not very fast growth, averaging at 4.3%/a over the past 10 years.

Indonesia has passed South Korea in volume growth, India and Vietnam also in good growth phase.

Indonesia is by far the largest tissue net exporter and Hong Kong the largest net importer in the Asia Far East region.

Indonesia leading volume growth followed by South Korea and India.

Despite major delays in APP’s Indonesia expansion plans – the already realised and ongoing investments will result in overcapacity.

Recent growth rates of Chinese tissue consumption has been very strong but 2013 market growth was disappointing.

Senior Management Session:

How to stay ahead in sustainability both as a company and as an industry; Wesley Chiu, General Counsel, Asia Pacific, SCA Asia Pacific, China

SCA is one of the biggest names in personal care, tissue and forest products globally, with sales in over 100 countries. Asia is an important growth market for the company. SCA is the majority shareholder of Vinda, one of the largest tissue companies in China. This presentation will cover SCA’s sustainable practices globally and in China.

How to stay ahead in sustainability as a company and as an industry.

We see sustainability is not just a corporate social responsibility but also a business opportunity:

– Improve competitive edge

– Reduce cost

– Reduced risk level

– Attract investors

– Employer branding

– Strengthen the brand

Cost and CO2 saving: some European carbon reduction achievements:

Tena Flex: carbon footprint reduced by 17%

Tena Pants: carbon footprint reduced by 13%

SCA has over 20 years of expertise in Life Cycle Assessment, which it says is the only tool to provide a complete picture of a product’s environmental impact throughout its lifespan, from material creation to disposal.

Customer demand:

Walmart employs a quantitative evaluation scheme for supplier evaluation – only selective verification of supplier data

IKEA’s evaluation approach encompasses 14 criteria – standards are independently reviewed by external auditors

Driver for new product development

The environmental situation in China and implications for the tissue business; Sun Mingming, senior pulp and paper officer, WWF, China

An introduction of the global and Chinese environmental situations and the definitions of the most important environmental issues impacted by pulp and paper industries, such as deforestation and degradation, loss of biodiversity, and climate change. From geographic perspective, this report will introduce the high risk regions with certain social and environmental evidences.

Introductions of WWF Market Transformation Initiative. With the defined theory of change, WWF will promote sustainable production and consumption collaboratively and raise public awareness and create demand of responsible paper products such as FSC-certified paper.

Energy saving in tissue production; Zhang Qunfu, general manager and chief Engineer, Hengan, China

The Chinese tissue market’s short-term excess capacity, quality homogenisation, cost-decreasing pressure. In tissue cost structure, energy consumption accounts for manufacturing costs (excluding raw materials) around 70%, around 20% of total costs. To reduce the production cost by saving energy is very important. This paper briefly introduced the three main methods of energy saving: Project Energy-saving design, Energy-saving operation management and New technology for Energy-saving. Focus on six new energy saving technologies include: Insulated head cover of Yankee, Revaporation from Hood exhaust, Steel Yankee Dryer, ViscoNip Press, Large Dia. Suction Press Roll, PU cover of SPR.

It found:

Chinese tissue market’s short-term excess capacity, quality homogenisation, cost-decreasing pressure.

In tissue cost structure, energy consumption accounts for manufacturing costs (excelling raw materials) around 70%, around 20% of total costs.

Energy-saving design project: tissue line tailored, planning grades, choosing suitable machine configuration with fit speed, capacity and ancillary equipment. Process design shortening and optimising, cutting low-efficiency process.

Energy-saving operation management:

– Improving efficiency, cutting production cost

– Automatic roll changing system, using ceramic blade

– Improving rewinding/converting efficiency

– Slitting and core shaft system, no rewinding

– Increasing Headbox stock consistency, saving electrical consumption

– Dewatering optimisation of tissue machine forming and pressings section

– Fabrics optimisation for tissue production

New technology for energy-saving:

– Insulated head cover of Yankee

– Revaporation from Hood exhaust

– Steel Yankee dryer

– ViscoNip Press

– Large dia. suction press roll

– PU cover of SPR

Insulated head cover of Yankee:

Normally the temperature at open header cover of Yankee dryer is around 150 degrees celcius, so energy lost of heat radiation is high.

Utilisation of insulated head cover can save 2.5%-5% of steam consumption.

Advantage of Visconip press:

Possible tissue dryness would be increased 7% by increasing peak pressure up to 4.5MPa, this dryness increase corresponds to a drying energy saving 25%.

Gives a bulk increase of around 10% compared to suction pressure roll and improves softness.

Economic impact of greenhouse gas emissions regulations; Stanley Okoro, general manager, Fisher International, USA

Globally, T&T production emits more carbon per tonne of paper than any other grade. What’s more, coal burning power plants in China and Indonesia have the highest CO2 emission factors. With the potential to alter the competitive position of individual mills, the carbon issue is becoming increasingly important for owners that need to understand the position of their assets compared to their peers.

Using Fisher International’s database of the CO2 emissions of every operating mill and machine in the world, this analysis found that:

- China’s response to air pollution and global warming has started

- Its GHG emissions for all paper products are among the highest in the World; its GHG emission is high among T&T producers, although lower than the US

- The US’s GHG is higher than China’s because it produces more tissue with TAD technology than China does – 38% of T&T production in the US uses TAD while it’s just 4% in China

- TAD is energy intensive compared to conventional Yankee drying and requires four times as much fuel and 60% more electricity

- China’s use of coal makes its energy costs low. However, coal worsens China’s GHG position. Coal is the biggest GHG producer among major fuels used by pulp and paper mills, and is the cause of China’s GHG-intensity and also of heavy pollution

- China is putting more energy-related regulations in place

- Converting from coal to gas or biomass could give China’s T&T industry a leading GHG position

- Use of biomass fuels is largely impractical. Only a minor percent of Chinese tonnes have access to waste fibre through their normal operations

- Only mills making virgin fibre onsite have natural access to biofuels and natural gas is relatively expensive in China

- Switching from coal to natural gas boilers would cost the industry billions

- Today in China, natural gas costs about twice as much per GJ as coal

- Energy efficiency and switching away from coal are the practical GHG reduction choices

- What Is the Economic Impact of GHG Regulations? Switching entirely from coal to natural gas today would cost the Chinese paper industry

- Increase in electricity purchases from utilities; $3.5 billion incremental cost in mill fuel purchases; Billions to rebuild or replace its 400 boilers; Energy regulations would cause some mills to fail

- However, converting from coal would create large opportunities for equipment suppliers

A helicopter view on China’s retail landscape, Hewitt Lv, director, Nielsen

An overview of how Chinese retail marketing has been changing and developing in recent years. The key FMCG trends include total Chinese FMCG goods growth trend, for example: what is popular in China, to help the audience find the right opportunities.

Besides the consumer goods trend, retail channel evolution will also be covered, focusing on the retail channel structure changes. Another important aspect is consumer behaviour from what consumers purchase in retail stores, the total tissue market trends will be shared during the session.

Key points are:

1. The total tissue development in the past three years. Growing? Flat? Or declined?

2. Segment information to help audience understand which segment is more favorable in China.

3. Competitive environment.

4. The impact of eCommerce on the tissue market.

The talk reported:

Vast market: lower tier cities are robust and are driving sustainable growth.

Modern trade has developed quickly in the past 10 years while traditional trade has been fairly stagnant.

Modern trade grew steadily in store count and contributed 46% sales to total FMCG.

The “convenience” channel in modern trade witness the stronger growth.

Online FMCG retail sales growth continued to slow down.

Slowing down growth was witness across most food and non-food super categories.

Online not only changing retail landscape but also changing consumer behaviours – more than six million e-shops on Chinese e-commerce company Alibaba; more than 600 million products on Alibaba.

Dry tissue (bathroom and facial tissue) is a 30bn RMB business while growth was slowing down in recent months. However, strong organic growth was still observed and innovation is the key to further drive market growth.

Lower tier cities overall grew faster than key cities.

The Chinese retail landscape is revolving with uncapped opportunities.

Other talks included:

A new tissue structure analyser for detailed sheet evaluation

Clayton Campbell, senior manager global business development, Kemira, USA

Huang Xiaosong, Tissue Sr. Research Scientist, Kemira (Asia) Co. Ltd., China.

Engineered base and batt optimisation in press felts to improve energy consumption on tissue machines

Thomas Flanders, director of Paper Technology-Asia, Xerium Technologies, Inc., China

Zhuang HuaWen, China Sales Manager – PMC, Xerium Technology, Inc., China.

Results of successful implementation of NipcoFlex-T Shoe Press Technology in Asia

Wang Xunyi, deputy director, Voith Paper (China)Co. Ltd., China

Ronaldo Parucker, Vice President Tissue Sales, Voith Paper (China) Co. Ltd., China.

Water closure – maintaining quality, productivity, and costs with reduced fresh water consumption

Nick Ince, market segment manager, Asia Pacific, Solenis, China

Richard Dong, Platform Launch Leader, Tissue +Towel, Solenis, China.

Modular, flexible and efficient tissue packaging solutions tailored for the Chinese market

Ruggero Squarzoni, area sales manager, Tissue Machinery Co. – TMC, Italy

Xiong Moke, Customer Care, Tissue Machinery Co. – TMC, Italy.

Innovations with Nordic softwood pulps and services for better tissue properties

Tuomo Niemi, Fibre Technology Manager, Metsä Fibre Oy, Finland

Zhang Tao, customer service manager, Metsä Fibre Shanghai Representative Office, China.

High energy-efficiency vacuum syystems for tissue machines

Yang Fenghui, marketing director, Runtech Systems Oy, Finland

Jukka Lehto, chief executive, Runtech Systems Oy, Finland.

Innovative technology solutions for the unwinders

Filippo Bertolli, sales area manager, Gambini SpA, Italy

Charles Yip, Tech.Vantage International Ltd., Hong Kong.

Energy saving – use of syngas in high efficiency hoods

Giulio Pengo, sales area manager, Novimpianti Drying Technology SRL, Italy.