Pulp price is the single most important driver of tissue profitability. Currently at a record high, analysts point towards a temporarily more static market, and even a modest decrease. Report for TWM by Pirkko Petäjä, principal, Pöyry Management Consulting.

Pulp prices have been at a record high for a lengthy period

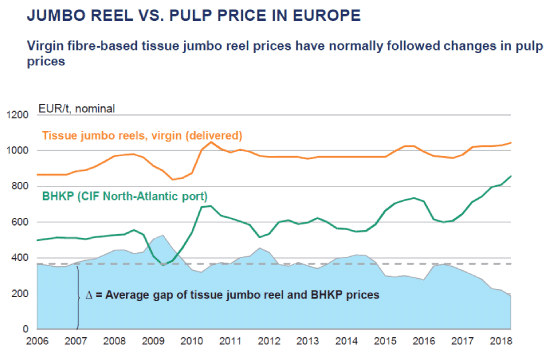

Market pulp prices have continuously risen in Europe since the end of 2016. Q3-18 prices still show a small increase for both BSKP (Bleached Softwood Kraft Pulp) and BHKP (Bleached Hardwood Kraft Pulp), but there are indicators showing that prices are finally levelling. Most analysts project a modest decrease. In real 2017 US$ terms, pulp prices reached an equally high level last time some twenty years ago, in 2000-2001.

Pulp prices are strongly impacted by the economic cycles and global supply and trade disturbances

During the economic high cycle everything that consumes paper is booming. Rising paper and board production increases pulp demand.When the demand increases it takes time before the pulp supply can react and a balance is found anew. On the other hand, when pulp supply increases, the steps are very large resulting often in a clear oversupply, especially in an economic downturn. This puts downward pressure on the pulp prices.

Market pulp is a global commodity and the prices, in all markets, are very much impacted by the demand from China, the largest and fastest growing consumer of pulp. Pulp prices were low in 2016, weakened by China’s slowing economy. A pick-up in the economic momentum in 2017 spurred higher demand for both BHKP and BSKP, which the market could not meet due to a few large mills closing unexpectedly and other smaller supply losses. This and the Chinese ban on recovered fibre imports and consequently increasing demand on market pulp have kept the markets tight and the current pulp prices high.

Trade battles can further complicate the matter. China and the US have already put tariffs on large number of products, including pulp and paper. If the USA penalises imports from China further and China retaliates, as is to be expected, the consequences are threatening for the pulp and paper industry globally.

The US’s gyrating politics can be scary, especially in case of a full-blown trade war. If Trump’s actions trigger a new global recession, the pulp price development will be very difficult to predict.

For instance, the political turmoil and low oil prices have already impacted the tissue industry in the Middle East where imported pulp prices are high and the economic situation has made it difficult to transfer the increased pulp costs to the product prices.

Pulp price movements can be forecast, but it is often difficult to see the exact timing and magnitude of the changes

Root causes for the pulp price movements can be understood and certain indicators followed in order to forecast the pulp price changes.

The long-term trend price forecasting process focuses on analysing the anticipated changes in pulp supply and demand environment, and consequent implications on the cost position of marginal producers near the high end of the cost curve and cost leaders with low production but high capital costs.

The market BKP trend prices continue to decline, driven by higher productivity, closures of high cost assets and the new coming onstream increasingly to the low cost regions. Large, over one million tonne pulp mills based on plantation wood and best available technology replace higher cost mills and marginal producers’ cost level continues to decline.

For the short term forecasts, economic indicators, exchange rates, stock levels and short term changes and disturbances are monitored, especially in the supply side. The currently high BSKP price is expected to level near the end of 2018 and start decreasing early 2019 due to an increased supply with fewer expected production losses and a temporary demand slowdown, partly due to de-stocking.

Canfor’s repair shut down in Northwood, extended shut downs after the hurricane in the Carolinas as well as suppliers’ announcements of price increases in the US and China put some upward pressure still on Q4 prices, while other fundamentals indicate a drop of the BSKP prices.

BHKP prices are widely forecast to start declining, as the supply/demand balance is expected to weaken in early 2019 due to soft demand growth in China and some new capacity.

Recent weak operating rates are due to unfavourable weather, truck drivers’ strike in Brazil and boiler problems and other disturbances that are likely not to persist.

The gap between BSKP and BHKP prices in Europe is abnormally wide and will gradually normalise as the substitution of BSKP by BHKP accelerates and forces the gap down. If the BSKP prices do not fall enough, BHKP prices may stay on the current level a little longer.

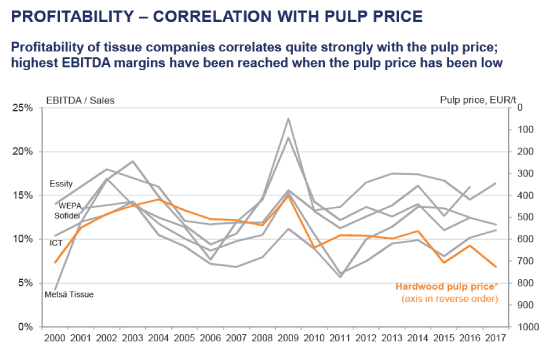

Tissue profitability is very much impacted by high pulp prices

Market pulp is the leading solution that comes to tissue fibre sourcing; integration to virgin fibre is relatively rare. Less than 15 % of the global tissue capacity is vertically integrated to virgin fibre. However, the trend towards integration is increasing, especially now with high pulp prices as the integrated players have benefitted from their lower fibre costs or at least of the flexibility how to see it. Especially in Asia and Latin America, tissue integration has been rising, but also in Europe, more integration to fibre is seen.

The current pulp prices account for some 70% of virgin tissue jumbo reel costs and about 50 % of the converted product costs. It is clear that pulp price is the single most important driver for the tissue business profitability. The fibre integrated players have had a major advantage since last year. This has further increased the interest of the integrated concept.

Recovered fibre has had a declining trend in tissue furnish due to decreasing availability of high quality recovered paper in the long run. However, in the current situation those who already have recovered fibre treating capacity have enjoyed of the lesser dependence on the virgin fibre market pulp. The inbuilt flexibility of the fibre furnish has been in good use recently.

Tissue and pulp price dynamics

Tissue product prices generally follow the pulp price movements; jumbo reels (JR) with a lag of 1-2 quarters and finished products with a longer time lag, e.g. some 4-5 quarters.

As JR prices follow the pulp price movements, the historical gap between the prices has been rather constant. During recent years the price gap has, however, slightly decreased.

The finished goods prices are more resistant to pulp price fluctuations, but still follow the pulp price fluctuations with less amplitude and with a longer delay than jumbo reels. This is how the current tough pricing environment for the tissue players has developed.

The situation has been particularly difficult for independent converters as purchased jumbo reel prices have already increased and for these smallish players it has been particularly difficult to transfer the high raw material prices to their selling prices.

Can the high pulp prices be transferred to tissue finished product prices?

Increasing the finished product prices due to the high pulp prices has been a vital target for many tissue companies since mid-2017. Not everybody is in a similar position; there are the ‘must-have brands’ that are so important for the retailers that they just have had to accept the proposed price increases. These players set a price umbrella for the markets. Large suppliers have a similar market power. They can be branded or private label suppliers, but too large to be easily replaced and therefore there is a sufficient negotiation power backing their price increase initiatives.

Not even the companies with the best negotiating power have been able to increase the prices at the pace of the pulp price increase. Over 10% of price increase often result in a volume decrease even for the best products.

Typically the successful price increases have been at about 6-8%, but there is some upside due to the time lag, as the tissue price increases have fully started much later than the pulp price hikes.

Annual/multi-annual pulp contracts cover typically volumes, discounts and payment and delivery terms etc., but not the actual prices which are agreed upon monthly. Tissue price agreements are longer, for instance for four-six months, and they cannot follow the pulp prices sufficiently fast from the tissue supplier’s perspective.

Price dynamics can also be retailer driven. The retail competition, consolidation and other movements also impact tissue prices. Tissue is an important and profitable product category for the retailers. There is tough competition between the chains where a chain cannot increase its prices if it does not want to lose the business to the hard-discounters.

Consequently, the price increase for the tissue supplier is not necessarily always reflected in the retail self-price. In regions where the retailer competition is particularly tough, price increases are challenging, especially for the players with a low negotiation power.

What if the pulp prices remain high?

In the unlikely scenario that pulp prices will remain on the current levels in the longer run, the tissue industry will most likely find a way to adjust to the situation. Premiumisation, higher bulk, lower sheet count, developed embossing etc. justify higher prices per tonne and reduce the direct impact of the pulp costs.

Most likely there will be more polarisation to the cost driven competition and to the premium-end that competes with other means than price and can thus easier increase the prices.

Pöyry Management Consulting is the leading advisor to players within the global Paper, Pulp, Packaging and Hygiene sector (www.poyry.com).