By Pirkko Petäjä, Principal, Pöyry Management Consulting

The South East Asian region is among the fastest growing tissue markets worldwide, but tissue production in the region grows even faster

A distinctive feature of South East Asia is its cultural diversity. Of the six thousand languages spoken in the world today, an estimated thousand are found in South East Asia. Cultural impact from both China and India can be found.

Islam is the main religion, however not necessarily dominant in all the countries.

The ASEAN tissue market grows as an average 6.5 % per year

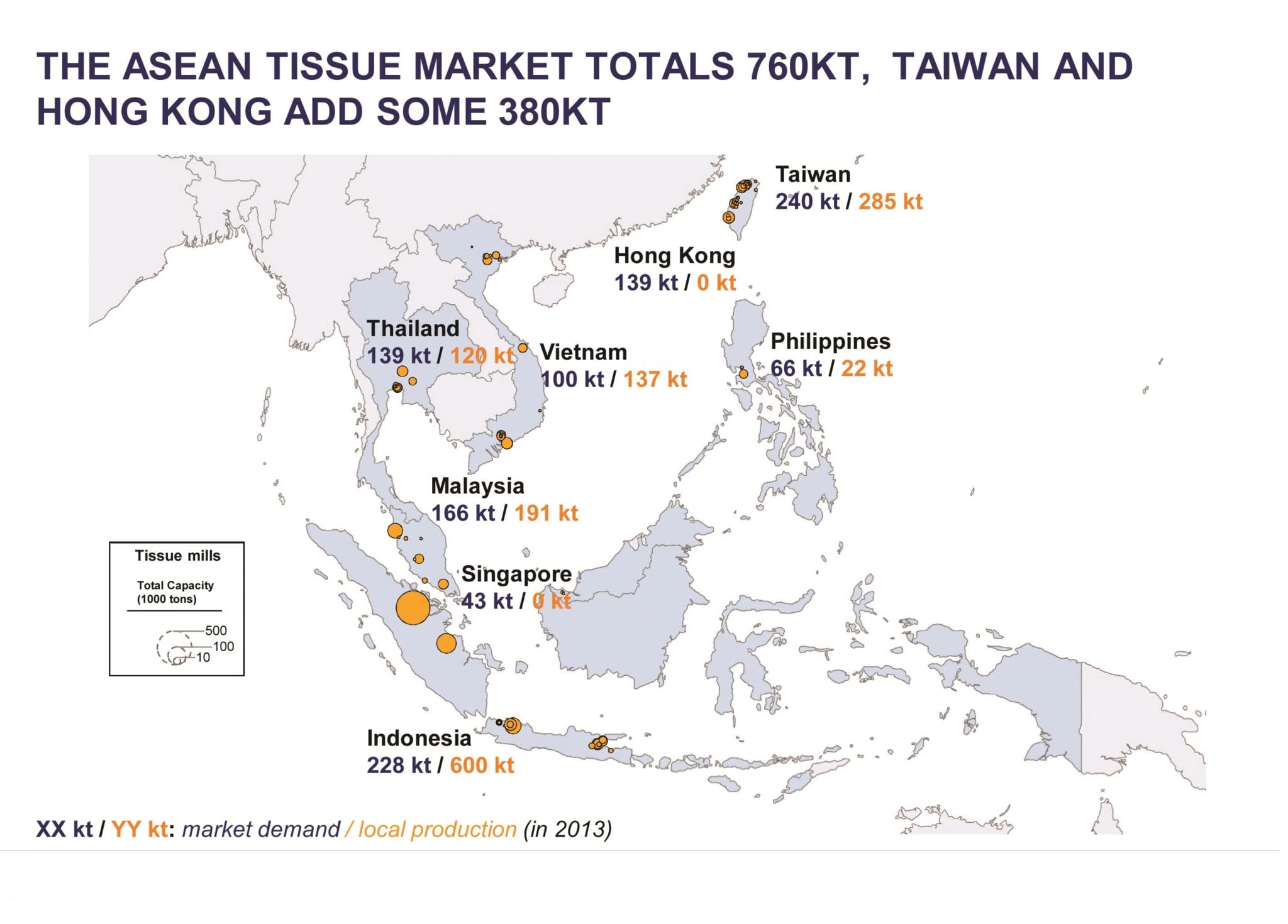

The South East Asian tissue market totals some 760,000tpy if only the ASEAN countries are included; including also Taiwan and Hong Kong the market totals over one million tonnes. Indonesia is the largest individual tissue market of the ASEAN countries at some 230,000tpy followed by Malaysia, Thailand and Vietnam. The Taiwanese market is a little larger than the Indonesian at 240,000tpy.

Tissue demand in the ASEAN countries grows as an average some 6,5 %/a, Vietnam and Indonesia accounting for the fastest growth rates. Markets in Taiwan and Hong Kong are more mature and grow clearly at a slower rate.

The ASEAN market is among the world’s fastest growing tissue markets on a par with the Chinese market.

Economic growth and other drivers in the markets

The tissue per capita consumption is still low in this emerging market area; (1-2 kg/capita in Indonesia, Vietnam, Thailand, some 5-6 kg/capita in Malaysia and some 10 kg/capita in Taiwan). This is even below what can be expected based on the GDP per capita levels. The GDP growth in many of the important South East Asian countries is strong at 6-7 %/a. The tissue demand growth follows the economic growth, but has even stronger growth due to the currently very low per capita consumption and also due to producers’ actions and supply push i.e. increasing availability and variety of products.

A developed retail structure accelerates the tissue market growth and it is easier to do business in the areas where the trade is rather developed. The strong position of traditional trade, street shops and small markets in many of the South East Asian countries makes the distribution difficult for large foreign companies and favours local supply.

Quality requirements in the markets

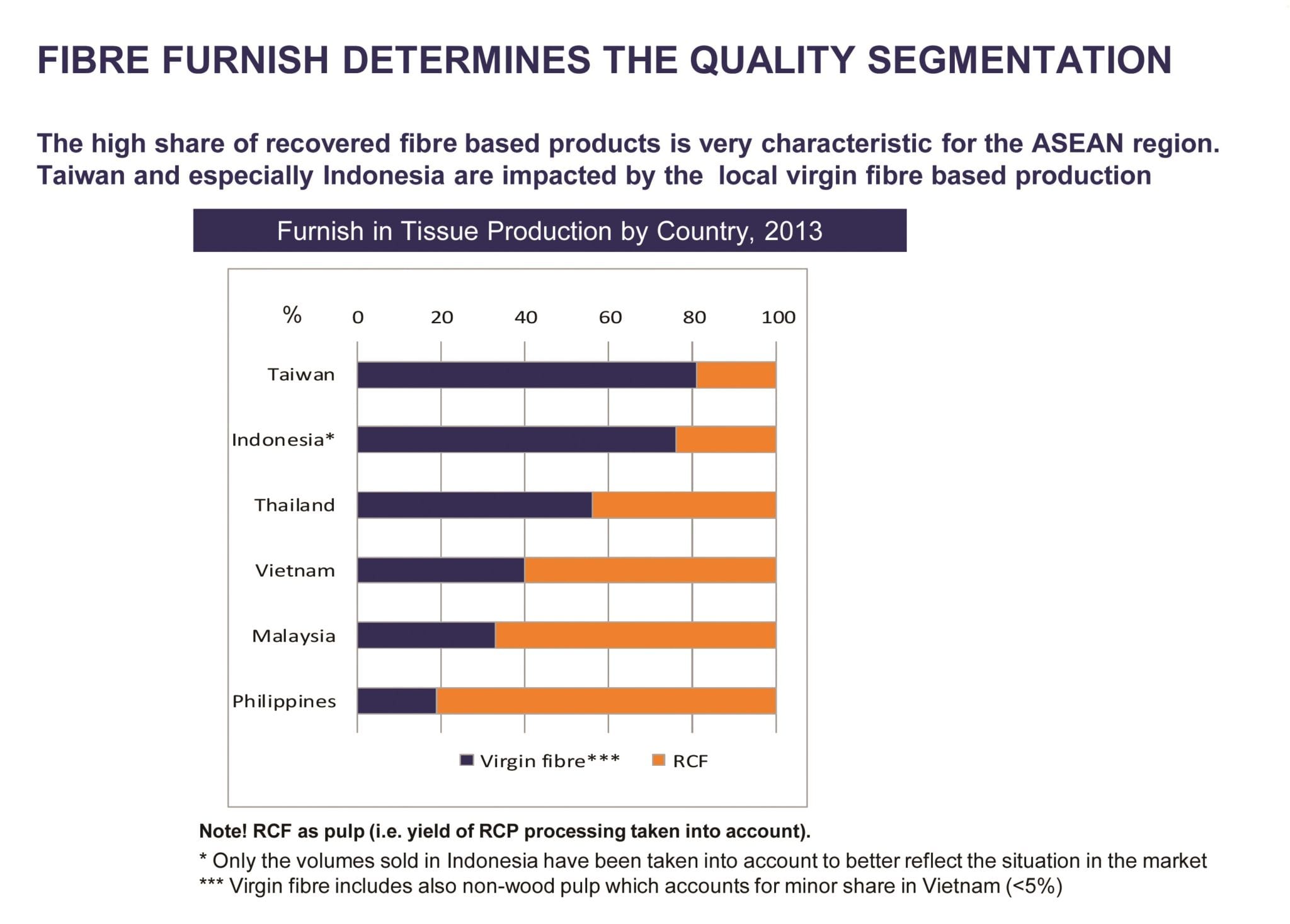

South East Asian region is typically an emerging market where quality requirements are not necessary as demanding as in the more mature markets. Also the purchasing power can be low favouring lower quality and for instance low priced low quality recovered fibre based products.

The lower quality levels are often locally produced as the prices cannot cover much transportation costs.

Hong Kong, but especially Singapore and Taiwan have high share of somewhat better quality products with value adding features. The Indonesian average quality is impacted by the high market share of APP that based on own pulp production produces virgin fibre based products and by the availability of local market pulp from APRIL; the mid-segment is relatively larger than the purely recovered fibre based lowest quality segment.

However, generally the high share of recovered fibre based products is very characteristic for the ASEAN region. This includes both mixed pulp and 100% RCP based products. The fibre furnish is the main differentiating factor for quality segmentation.

Main players in the market are mostly local Asian companies. APP is by far the largest supplier

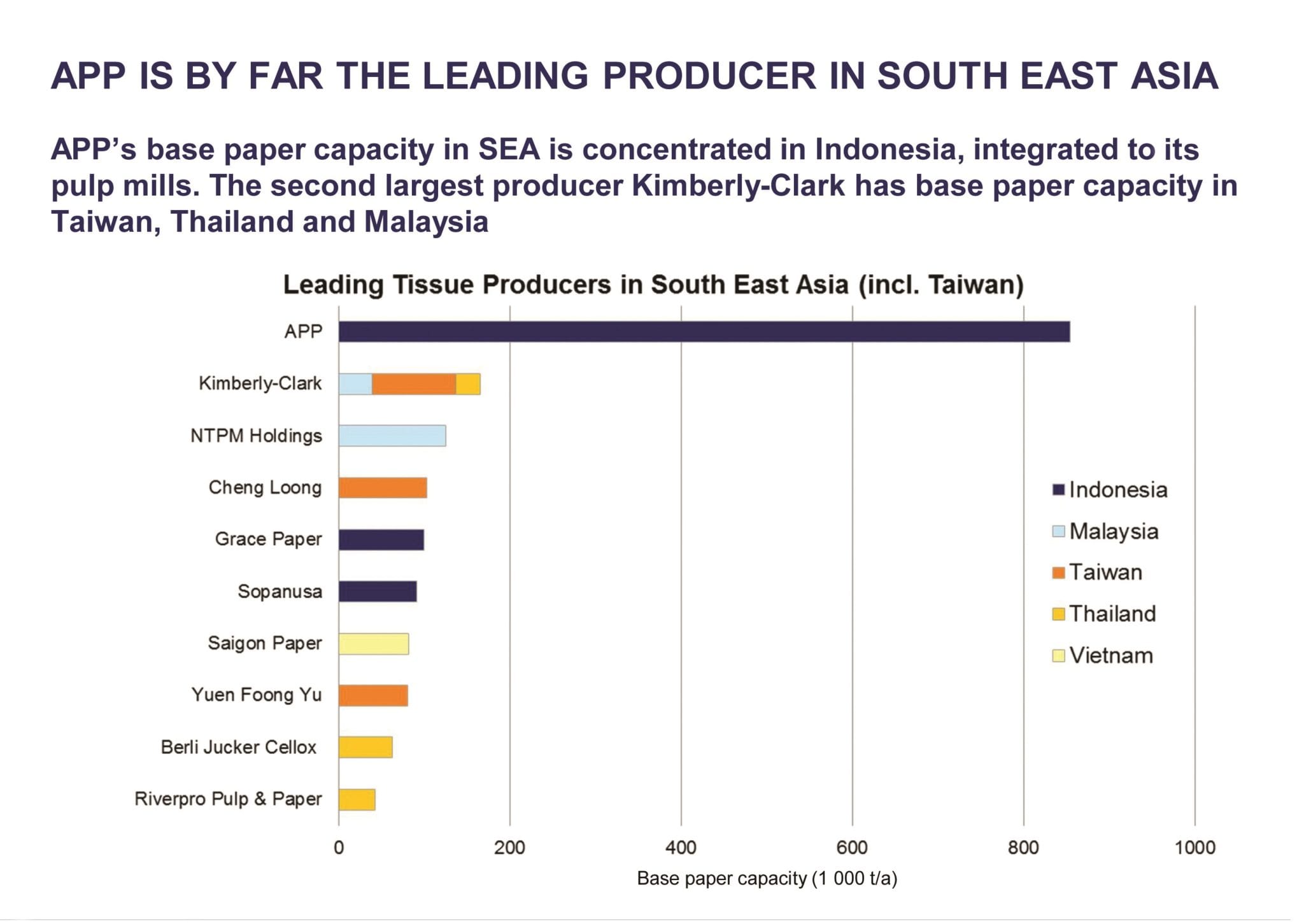

By far the largest tissue player in the region is the Indonesian based Asia Pulp and Paper (APP). APP’s tissue base paper capacity in Indonesia totals 2015 some 800,000tpy and is planned to be increasing with giant steps; the latest machines are all large and planned to be (and already are) installed in multiples. Currently APP has three tissue base paper mills in Indonesia and is planning a fourth large site. Typically most of APP mills are pulp integrated to own plantation based BHKP mills.

Kimberly-Clark is the second largest player in the region. K-C has several production bases in the main South East Asian countries but the tissue machines are typically old and small in capacity. K-C’s capacity in South East Asia totals close to some 200,000tpy.

All other players are more or less local, have production in one country with some limited exports to the neighbouring countries. Largest such players include the Malaysian based NTMP, Indonesian based Grace Paper and Sopanusa and a couple of Taiwanese and Vietnamese players. Chinese imports are also important in many of the South East Asian markets.

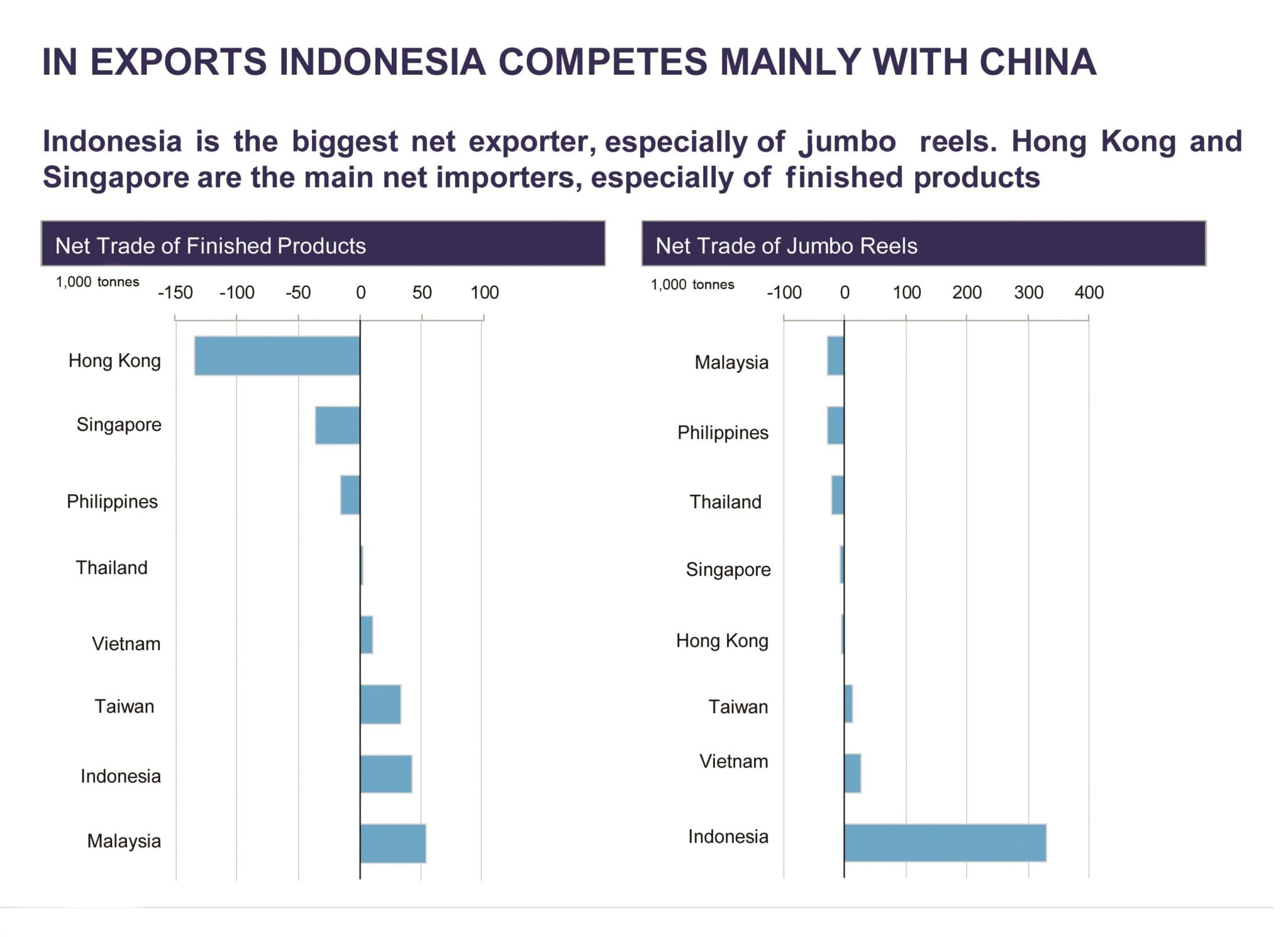

Indonesia is the biggest net exporter, especially of jumbo reels, Hong Kong and Singapore are net importers

Indonesia, there especially APP, is a large low cost producer with excellent prerequisites to export tissue to the neighboring South East Asian countries. Indonesia exports almost 400,000tpy to the region and overseas. Exports are mainly in the form of jumbo reels, but finished products are also exported.

Hong Kong and Singapore do not have local tissue production and are therefore large net importers, also in Philippines the local production is weak in relation to the size of the local market.

Indonesia competes with the Chinese exports to the region; for instance in Hong Kong practically all the imports are from China, but Chinese exporters are to some extent present in practically all the markets.

China’s impact on South East Asian tissue market

The China tissue market has been growing at 8% per annum over the last decade and China has become the second largest tissue market in the world after North America followed by Western Europe as the third. Following the brisk market growth the increase of capacity in China has been very fast. Tissue capacity doubled from 2008 to 2014 as tissue became a hot investment spot, however, overinvestment has resulted in overcapacity and has further caused continuous drop in the operating rates.

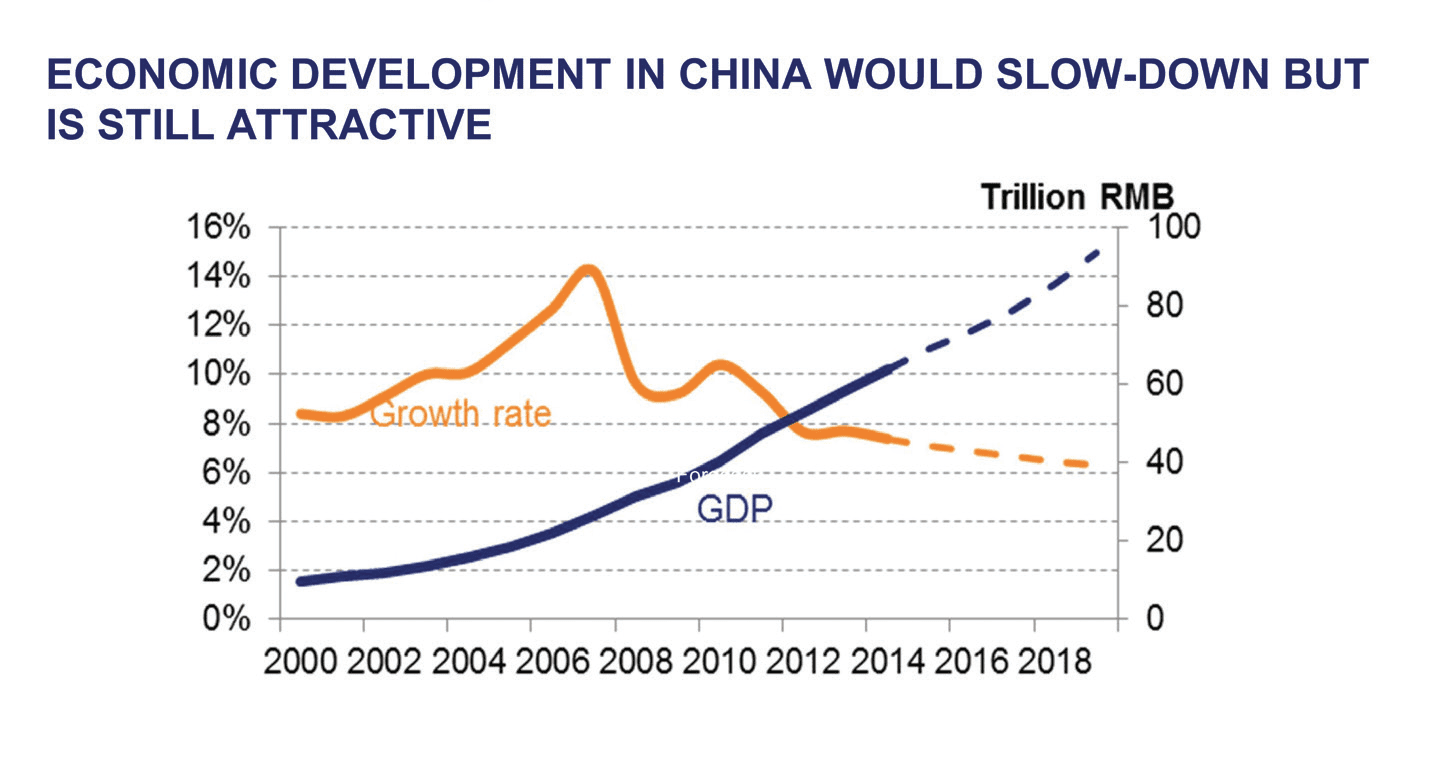

Alongside with the global economy China’s GDP growth has clearly slowed down since 2008. However, it is forecast that China would keep a relative steady growth in the next few years till 2019 at over 6%/a. This is still a robust rate compared with developed countries, however, significantly lower than in the past.

This is slowing down the tissue growth rate which is expected to total 5.6%/a by 2020. This is the long term prospect but quite recently the Chinese economy has been showing more turbulence than what has been anticipated.

Longer term capex plans are still ambitious causing closure of old uncompetitive capacity, change of geographic focus and increases pressure for exports. Consequently the tissue capacity in China is moving inland from the coast and especially the largest companies focus exports also for overseas.

Within South East Asian area the biggest importers from China are Hong Kong, Taiwan, Philippines and Singapore. In other South East Asian markets the Chinese exports are only marginal. In Hong Kong where there is no local base paper production, the Chinese imports account for almost 90% of the market, being mainly finished products. In addition to Hong Kong, Taiwan and Singapore are the only markets where Chinese imports are bigger than for instance the Indonesian.

Latest developments in China’s economy

The Chinese economy grew 7% during the first half of 2015. China reported that it’s Purchasing Managers’ Index (PMI), an indicator of manufacturing activity and a key measure of economic health, fell in August 2015 to 47%, a six-year low.

Consequently China’s economy is heading for its weakest performance in 25 years, and the recent poor data indicates it might not even meet its 7% growth target for this year. While the Chinese economy is unlikely to crash anytime soon, China nonetheless faces a high probability of being the next major power to face an economic collapse.

China’s massive industrial output has increased wildly due to the vicious competition between local governments. In order to achieve high GDP growth, local governments have tried to attract new manufacturing facilities by offering financial subsidies such as tax holidays and rent-free use of government land. Further, local governments help firms to get cheap loans from state-owned banks.

As a result the industrial overcapacity has become a time bomb that threatens the Chinese economy because it has led companies to take on debt to repay loans. Overcapacity is a serious problem also in the tissue industry. The combination of economic slowdown, excess production in manufacturing and rising debts at the macroeconomic level may cause a massive wave of firm closures and bad loans.

Is a slower growth good or bad?

China has long been the engine of the world economy. However, in a time of global depression, the country’s growth rate has cooled down compared with the even double-digit growth the country has enjoyed in the past. Therefore China’s current economic figures have garnered a lot of attention.

How to see China’s current GDP growth rate? Due to the slowdown, the Chinese government could remove some of the overheating that has been a problem in the past. Can slowing down after all be for the best?

China’s economic slowdown comes at a time when the country is transitioning its economic model, diminishing its reliance on manufacturing for export and government investment in core industries while boosting domestic consumption as a new driver of the economy.

China is undergoing a massive transformation from a cheap exports nation to one that is self-reliant on its vast middle class and innovation to drive growth. With the Chinese president’s words China has moved from “speed-based growth to quality-based growth.”

If China manages to reengineer its new growth model, the country will be moving towards the next stage of development.

Maritime Silk Road initiative for ASEAN co-operation

As the Chinese economy is developing from the cheap exports nation towards relying on sustainable own middle class purchasing power, the Chinese economic turmoil is not expected to impact the South East Asian tissue market very much. The trade flows are rather towards China than from China regarding the ASEAN countries, especially Indonesia. The export pressure is expected to be short term and threat of investing in overcapacity is mitigated by the slowdown and delay of the planned investments.

In addition, China has prepared mechanisms to support possible production capacity cooperation with the ASEAN Economic Community (AEC) with its “Maritime Silk Road” initiative, enabling the economies to have best possible distribution and transportation of resources to boost up the co-operation. The entire “Silk Road Economic Belt” is a far reaching initiative sometimes called the “Chinese Marshall Plan”. China hopes to gain closer cultural and political ties, functioning community and economic trade routes within the altogether 65 countries in the entire Silk Road (of which the Maritime Silk Road is a part).

Slowdown in China is only a temporary threat

Slowdown of the Chinese economy causes at least temporary tissue export pressure to the South East Asian countries. However the Chinese economy developing towards boosting the domestic consumption “quality based growth” and slowdown of investments may on the contrary ease the overcapacity situation in the whole region on the long term.

Pirkko Petäjä is a principal at Pöyry Management Consulting.