Steady population growth, population ageing and rising per capita consumption have combined to push tissue production in Australia to capacity. The question for the Australian tissue market is when, and where, the next manufacturing development will come. By Tim Woods, managing director, IndustryEdge

Australia is a developed and mature economy. In general, its consumption of tissue and tissue products is expected to also be mature. Yet its growing and simultaneously ageing population has expanded its consumption of tissue products over the last decade.

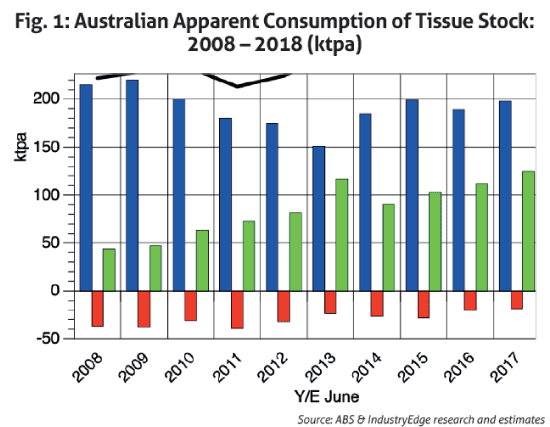

The country’s consumption of tissue stock rose 5.6% over the year-ended June 2018, reaching 321,000 tonnes. The new record was delivered courtesy

of a solid increase in local tissue production, as Figure 1 shows.

Production lifted 9.6% on the prior year, to 217,000 tonnes, with the small

volume of exports largely stable and the larger volume of imports modestly lower than the prior year. Local sales accounted for 62% of apparent

consumption for the year, with imports holding 38% of the market.

It is important to note that apparent consumption is not the same thing

as actual consumption or demand. The Australian data does not include

inventory movements, which in a small market could account for 8% to 10% of the consumption in any year.

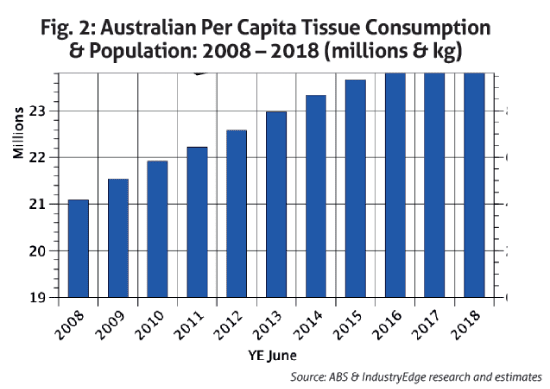

Per capita consumption rises to 13.0 kg

Australians are, on the latest data, using an average 13.0 kg of tissue per annum, every year. The growth in per capita consumption over the decade has averaged 2.1% per year, which can be seen in Figure 2, along with Australia’s population.

To some, this solid growth in per capita tissue consumption is questionable,

especially because population growth of 1.6% per annum over the decade to 2018 helps to explain why more tissue is being consumed by the country, but does not explain why each person is consuming more.

But the nature of the population growth, the ageing of the population, and the way in which Australians live their lives, is driving tissue consumption higher.

Put at its simplest, in addition to net migration, Australia’s population growth has been driven by increased births and less deaths, as the population ages. These are the two periods in a person’s life where they will use more tissue products (or at least As part of that, they live and eat outdoors, in an increasingly café culture. Some local tissue producers report their strongest sales growth in the AfH segments, especially related to

napkins, serviettes and towel products.

These factors, along with severe retail cost controls that has resulted in toilet paper being sold to consumers at the same price as a decade ago, are

pushing per capita consumption of tissue products higher, in the otherwise

mature Australian market.

As a comparison to the Australian experience, per capita tissue consumption in New Zealand was calculated at 11.5 kg per person for 2017-18. Growth in per capita consumption over the decade has been a more substantial average of 2.5% per annum.

Tissue production nears decadal highs

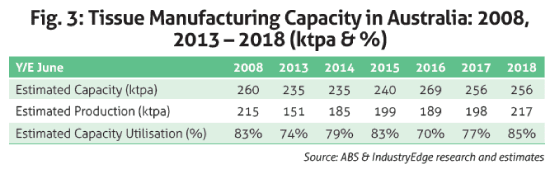

For all that Australian tissue consumption has grown strongly over the decade, production in the last financial year was just short of the decadal high. IndustryEdge assessed production as reaching 217,000 tonnes for the year, but this was below the peak of 220,000 tonnes achieved in 2008-09. Production of tissue in Australia, almost all supplied by imported pulp, is not remarkable in itself, but its growth from the prior year is very strong, as Figure 3 shows.

Other than general consumption growth, improved competitiveness of local manufacturing, fuelled by a depreciated Australian dollar, appears to have allowed local manufacturers to grow their production at the expense

of imports of tissue stock, and pre-converted tissue product imports.

Australia’s four tissue producers, the locally owned ABC Tissue and the much smaller Encore Tissue, the Australian Stock Exchange listed Asaleo Care in which Essity retains a significant share and the global giant Kimberly-Clark, have a combined capacity we estimate to be 256,000 tonnes per annum.

As we describe in the 2018 Pulp & Paper Strategic Review, history shows that it is at or around the 85% capacity utilisation mark that new capacity

has been introduced to the Australian tissue market.

For some time it has been widely considered that ABC Tissue would likely

deliver on the final instalment of its announced expansion plans at or around these levels. It commenced a program of investment in late 2014, and has been progressively introducing new production capacity. At the time of writing however, no announcements have been made or are understood to be imminent.

Imports stable, but their share has grown

With its close proximity to the rest of Asia, its stable economy and capacity

to pay, Australia has long been a key export destination for the region’s tissue producers.

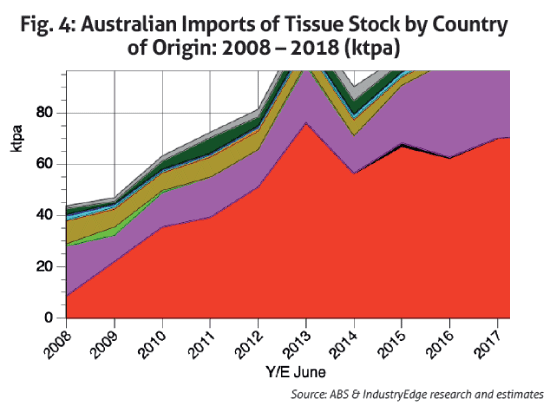

Imports of tissue to Australia grew very strongly through most of the last decade. Look back ten years and imports totalled just 43,800 tonnes and accounted for a little less than one-fifth of Australian consumption. A decade on and 123,400 tonnes of imports had almost doubled their influence, accounting for close to 39% of total consumption.

Across all time periods, two countries dominate, as Figure 4 shows. China is the dominant supplier, supported by an ever-growing presence from Indonesia. The other noticeable participant is New Zealand, not because of its volumes, but because these imports are from Asaleo Care’s New Zealand facility, back into the Australian market.

In the most recent year, shipments from China accounted for 58% of the total, and those from Indonesia, for 30%. By any measure, combined, the two countries dominate imports to Australia.

Perhaps counter-intuitively, the local producers are among the converters of the imported tissue. Under severe pressures from the domestic retailers to hold consumer prices, local producers have resorted to importing tissue stock, for conversion in Australia. In essence, they would rather control the

competition for their locally produced tissue than have little influence over it.

That there is still some margin in this approach is evident by the expanding Australian converting operations of Asia.

Pulp & Paper’s local affiliate, Solaris Paper. Its operations in Sydney and

Melbourne convert APP’s tissue stock. Cottonsoft, their sibling in New Zealand operates the same model.

Local producers fend off converted imports, despite higher pulp prices

In Australia, tissue producers are reliant on imported pulp for the significant majority of their fibre supplies. All of the local producers import pulp.

As global pulp prices increased over the last year, local producers faced a still larger impost because the Australian dollar had depreciated against the US dollar.

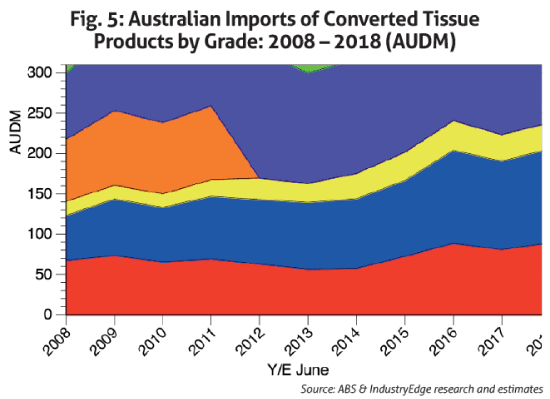

At the same time, the value of Australia’s imports of pre-converted tissue products was rising, in Australian dollar terms, primarily for the same reasons. Unfortunately, the pre-converted tissue import data is only available by value.

However, as Figure 5 shows, growth in the value of tissue product imports has slowed over the last two years, especially for the major products. The value of converted toilet tissue imports in 2017-18 was just 0.8% higher than

two years prior, while facial tissue imports were 1.0% higher over the

same period. The implication is that with prices rising, import volumes have declined.

Despite their reliance on higher-priced imported pulp, local producers have expanded their production and to some extent, displaced imports of pre-converted tissue products. It is not irrelevant that the major supplier

of facial tissue is Asaleo Care from its operations in New Zealand. Take that

supply out, and pre-converted tissue product imports to Australia have barely grown over the decade.

Tissue consumption will rise further

For all that it may seem Australia’s tissue consumption must be near its top,

IndustryEdge forecasts further growth to 2023. The model deploys three trend scenarios, each of which shows strong growth over the next half decade, from a low of 3.8% per annum to as much as 6.9% per annum. The forecast based on the prior five years of consumption experience suggests consumption will rise an average 5.6% per annum.

Although there are different considerations for each, our assessment

is the middle forecast is the most credible, assuming stable population growth and normal economic cycles. If it does eventuate, by 2023, Australia’s tissue consumption will be a little more than 420,000 tonnes per annum.

The really interesting question is whether the additional consumption will be supplied locally, or by imports, or a mix of the two. If there is an additional role for domestic production, the next questions are the by who, where, when and how much questions.

IndustryEdge is Australia’s and New Zealand’s paper and fibre market expert.

The firm publishes the monthly Pulp & Paper Edge and the annual Pulp & Paper Strategic Review, now in its 27th consecutive annual edition. www. industryedge.com.au