Imports equate to approximately 38% of Britain’s tissue consumption. Most of its fibre is non-EU supplied, and parent rolls and advanced process finished products could look to Turkey and the US to replace France and Italy.

The tissue business in the United Kingdom is part of machine-made paper manufacturing’s oldest history. The modern papermaking era started in the UK with the Fourdrinier brothers of London purchasing the continuous paper-making machine patent from French inventor Nicholas Robert.

Over time, UK residents have developed preferences that are unique but include some attributes of continental Europe and North America. Analysis of apparent tissue consumption shows UK tissue consumers used about 18kg/capita of tissue in 2016, up from about 13.5kg/capita in 2007. This cumulative average growth rate (CAGR) of 3.7% in consumption reflects the improved economy in the UK in the past ten years. While this rate leads users in Western Europe, it is lower than that of North America, indicating there is still room to grow if the economy continues its course.

The elephant in this room is Brexit as preparation of this report was done before the late March deadline, which has since been extended until 30 June 2019. With this uncertainty in mind, we will focus on the fundamentals of the UK’s tissue business and consumption, and then suggest the potential implications of various scenarios.

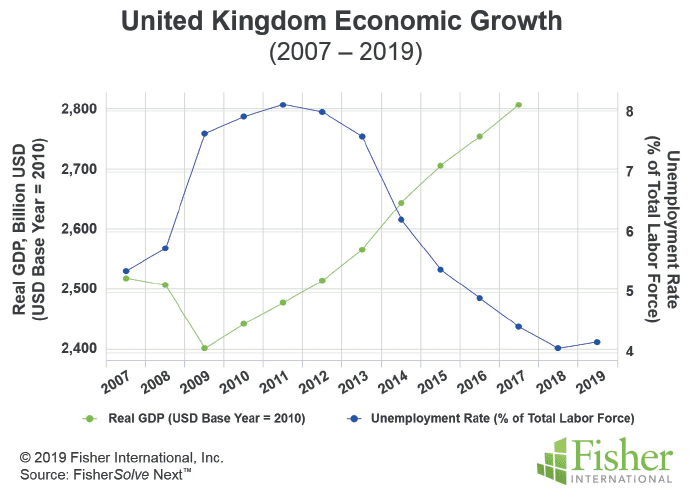

The region has enjoyed a strong economic recovery as shown in Figure 1. The blue curve shows the -6.5% CAGR reduction in unemployment starting in with the recovery in 2009 that corresponds to the green curve which shows GDP growth of 2.3% CAGR. These numbers are somewhat better than the experience of continental Western Europe and provide a basis for understanding the increased per capita tissue demand over the same period.

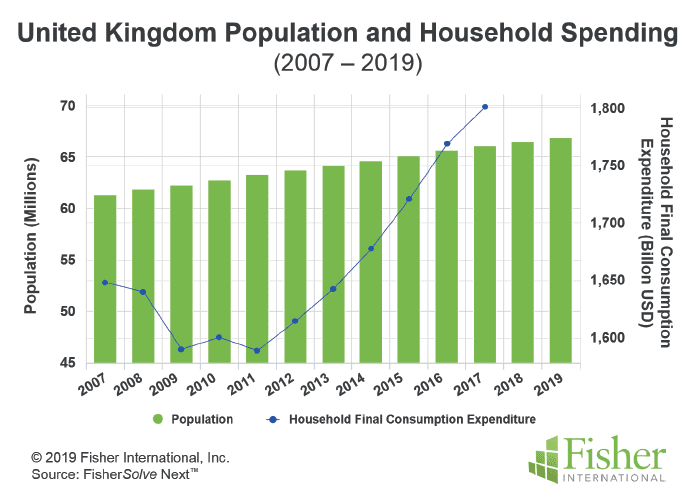

Figure 2 shows the population growth and household consumption expenditures for the United Kingdom in the relevant periods. UK population growth from 2009 to 2019 at CAGR of 0.8% was slightly higher than France or Germany. Household expenditures grew slightly faster at a CAGR of 1.8% over the same period.

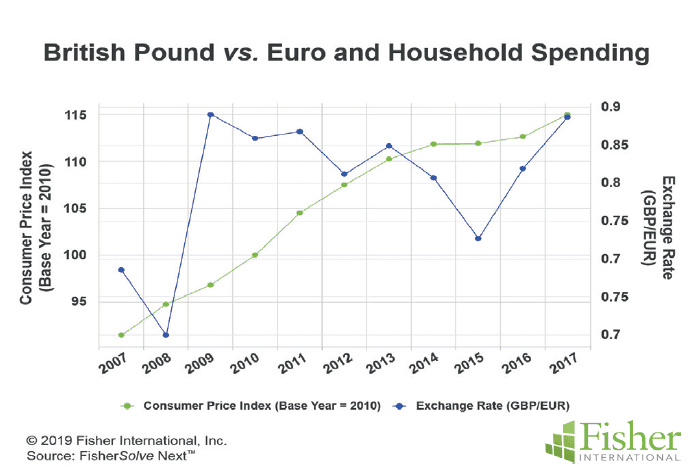

Figure 3 compares the relative value of the British Pound versus the Euro and the average consumer price index for the United Kingdom in the period from 2007 to 2017. Consumer prices, indicated by the green line, showed a steady but slow increase since 2009 resulting in a CAGR of 2.5%. The blue line shows the relative value of the British Pound versus the Euro over the same period. This data does not show the same clear recovery trend of the

previously discussed statistics. The relative value of the Euro rose close to the value of the British Pound in 2009 and 2017. The British Pound value has remained at this lower range with slight recovery shown in early 2019.

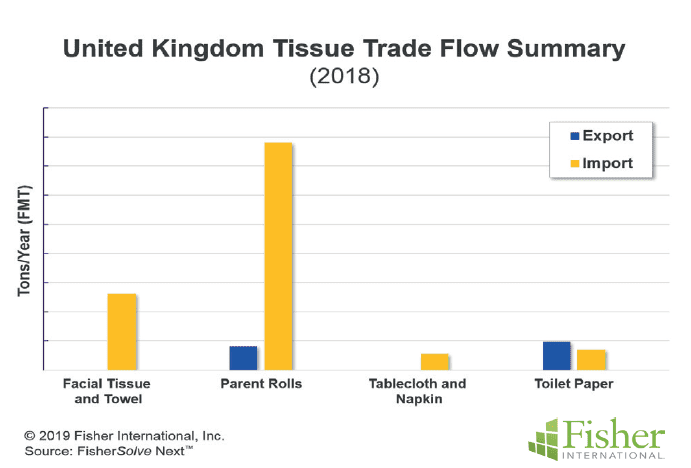

The United Kingdom tissue business consists of both domestic manufacturing, significant imports, and limited exports. The trade flow summary for 2018 data is shown in Figure 4. Tissue exports from the UK include converted finished toilet tissue, and some parent rolls. Ireland is a key customer of the toilet tissue. Imports to the UK include facial tissue and towel. Notable finished product imports are TAD kitchen towels from France. Most of the tissue imports to the UK are in the form of parent rolls for converting closer to the market. Turkey is the major source of parent rolls with additional materials coming from Italy. The net trade effect is almost 500,000 tonnes per year of tissue moving into the region, versus about 830,000 tonnes of local production. As a result, the UK imports approximately 38% of its tissue consumption which has tended to slow additions of domestic capacity. Including new projects underway for 2019, the total number of tissue machines operating will still decrease by one for the period 2007 to 2019.

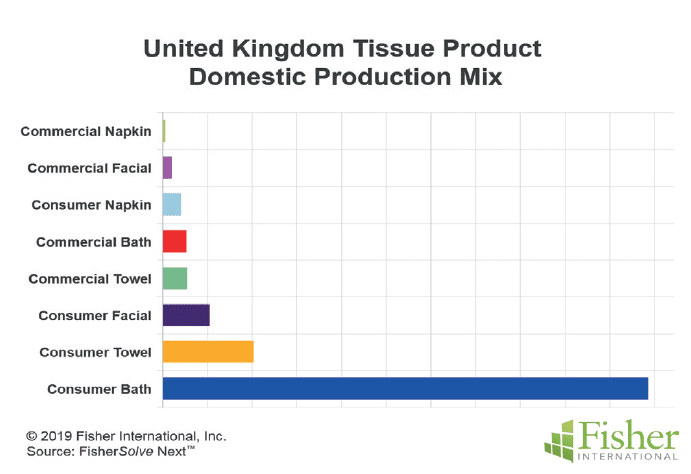

The tissue product mix shown in Figure 5 represents the domestic production mix. Consumption of towels is somewhat higher due to imports from both France and Italy. This adjustment would bring UK product consumption mix more in line with other developed countries in usage of paper kitchen roll towels. Commercial or AfH grade volumes are in line with other Western European countries and somewhat below that of North America.

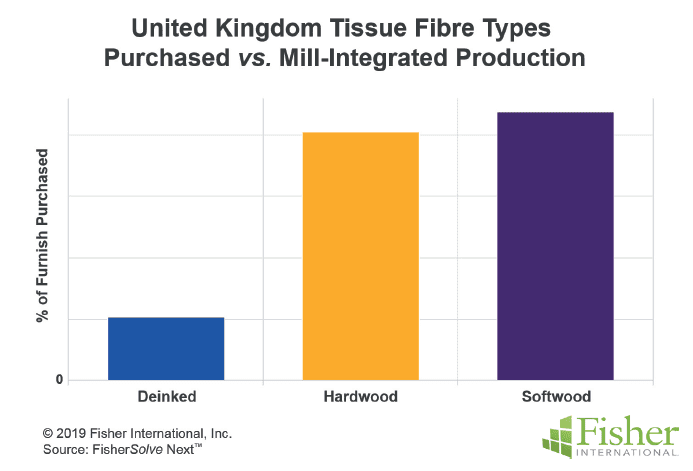

Tissue production is heavily dependent on imports of fibre. Figure 6 shows the percent of fibre purchased for tissue production by type. Almost 90% of softwood used for tissue production is purchased and brought to the tissue mill site. Hardwood fibre is 80% purchased. Deinked fibre is mostly made on-site with only 20% purchased.

Specialty tissue is all based on deinked fibre while commercial tissue is about 65% deinked fibre. The retail tissue grades have a much higher dependence on imported purchased virgin fibre. The limited integration of fibre and tissue production is the area of greatest cost risk for the UK tissue business. BCTMP pulp used in retail products is an attempt to reduce this cost. Presumably, this is used in kitchen towels where the increased bulk and absorbency associated with this hybrid fibre are appreciated versus the

probable loss of softness.

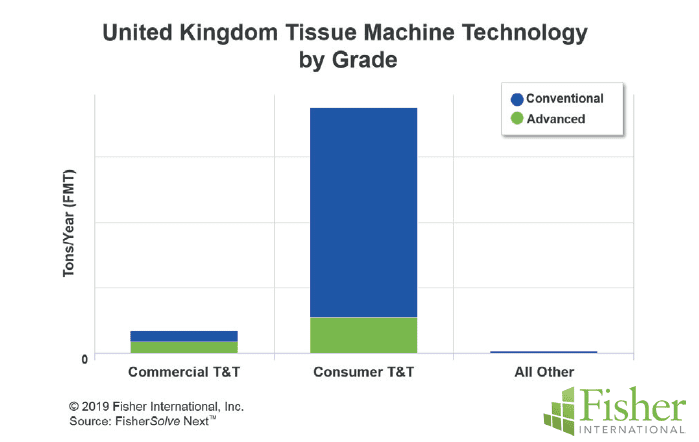

The area has several TAD or advanced structure tissue machines. Figure 7 shows the distribution of advanced tissue technology by tissue grade. Surprisingly, the commercial tissue grades show about half of the product volume uses advanced technologies. This is most likely driven by high performance hand towels used in health care and high-end office and hospitality applications. The advanced technology shown for retail grades is associated with high end toilet tissue and kitchen roll towels. This chart is based on the production volumes within the UK. The proportion of advanced technology would probably rise if the imported finished products

from France and Italy are included.

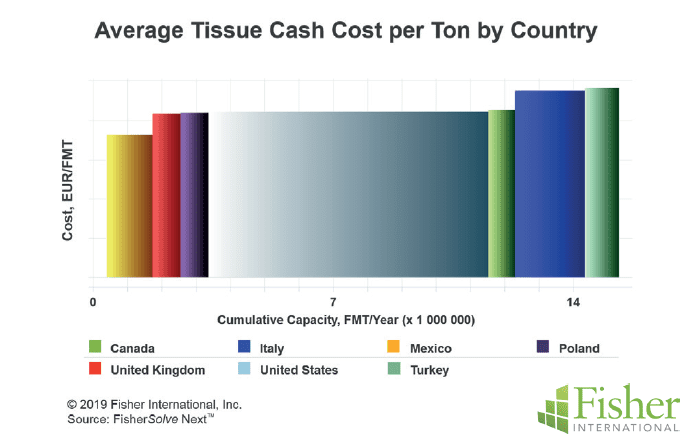

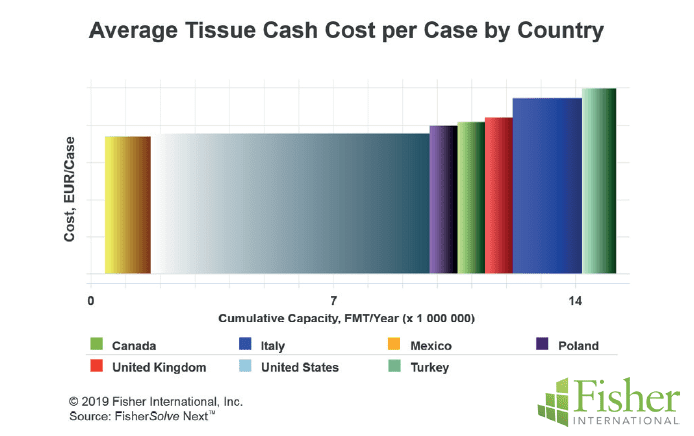

The region’s high reliance on tissue imports, especially in the form of parent rolls, requires comparison to existing and potential new trade partners as the new UK trade plan unfolds. A comparison set including Turkey, Italy and Poland was chosen to represent the current trade partners (Turkey) and European Union (Italy and Poland). Also included are the North American tissue manufacturing countries as potential trade partners.

Figure 8 shows that tissue production costs are on the low range when expressed on a per tonne basis. Figure 9 shows the effect of changing the cost curve to a case basis which shows the potential impact of advanced structured tissue technologies to offer higher performance at lower basis weight or grammage. This effect could make North American tissue production more cost effective because of the high percentage of advanced machines available.

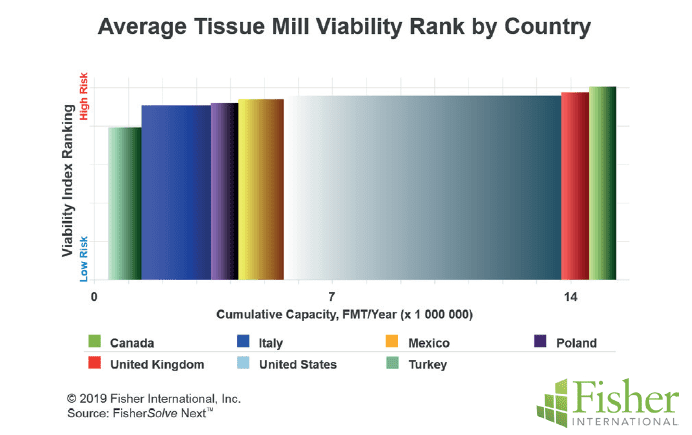

Figure 10 shows a future look. Mill viability looks at a weighted average of risks due to equipment, costs, fibre sourcing, and company structure. The older and mostly non-integrated UK mills rank poorer on this scale.

Uncertainty continues to build regarding the future structure of trade relationships. Initial volatility associated with this uncertainty is unlikely to represent the fundamentals of the UK tissue business. Fundamental supply effects can be judged by looking at current trade in raw materials, and finished goods. The United Kingdom is dependent on imported fibre. Most of the fibre purchased now is outside the European Union. Little change is expected here. The parent roll imports from Turkey also represent a major fibre input. This relationship is also unlikely to change if the UK leaves the EU. Additional tissue parent rolls and advanced tissue process finished products could also be imported from North America to replace imports from France and Italy.

The domestic tissue industry supply has tended not to keep up with demand growth. More machines have come out than have been installed. This difference has been made up by increasing imports, mostly of parent rolls. Will the potential effects of Brexit make building new capacity more or less likely?

On the demand side, the United Kingdom has enjoyed better economic growth since 2008 than its European Union trading partners. Tissue consumption per capita has been rising to meet the higher rates of Western Europe. Population growth was supported by immigration due to job availability. It is unclear how much these trends will be impacted in the long-term by leaving the European Union trade regime. It is likely to stall some of the demand growth rate in the short to medium term. This is probably the highest risk of Brexit.

This article presents a static picture summary of the United Kingdom’s tissue industry today. It is not possible to predict all the effects of Brexit on the tissue business, as the net results are unclear at this point. Fibre prices, exchange rates, and environmental regulations will change, giving some participants advantages and other challenges. Tissue companies will continue to change hands and perhaps consolidate; neighbouring countries may invest in tissue-making capacity thus affecting UK imports.

About Fisher International, Inc.

Fisher International, by virtue of its deep expertise in the pulp and paper industry, provides insights, intelligence, benchmarking, and modeling across myriad scenarios. By arming companies with the knowledge that will help them gain a better understanding of their strengths and help identify weaknesses, Fisher is helping businesses stave off challenges and better position themselves for long-term growth. For more information, visit http://www.fisheri.com, email [email protected] or call +1 203.854.5390 (USA)